A corporate holding is a corporate structure whose main purpose is to control, directly or indirectly, other companies by holding their quotas or shares.

By concentrating holdings in a single legal vehicle, a corporate holding company facilitates strategic management, protects the partners' assets and allows for more efficient tax and succession planning.

In this article, you'll learn in detail how a holding company works, its advantages, the steps to set it up, the tax aspects to consider and the main precautions to take to keep this structure in compliance with the law.

What characterizes a holding company

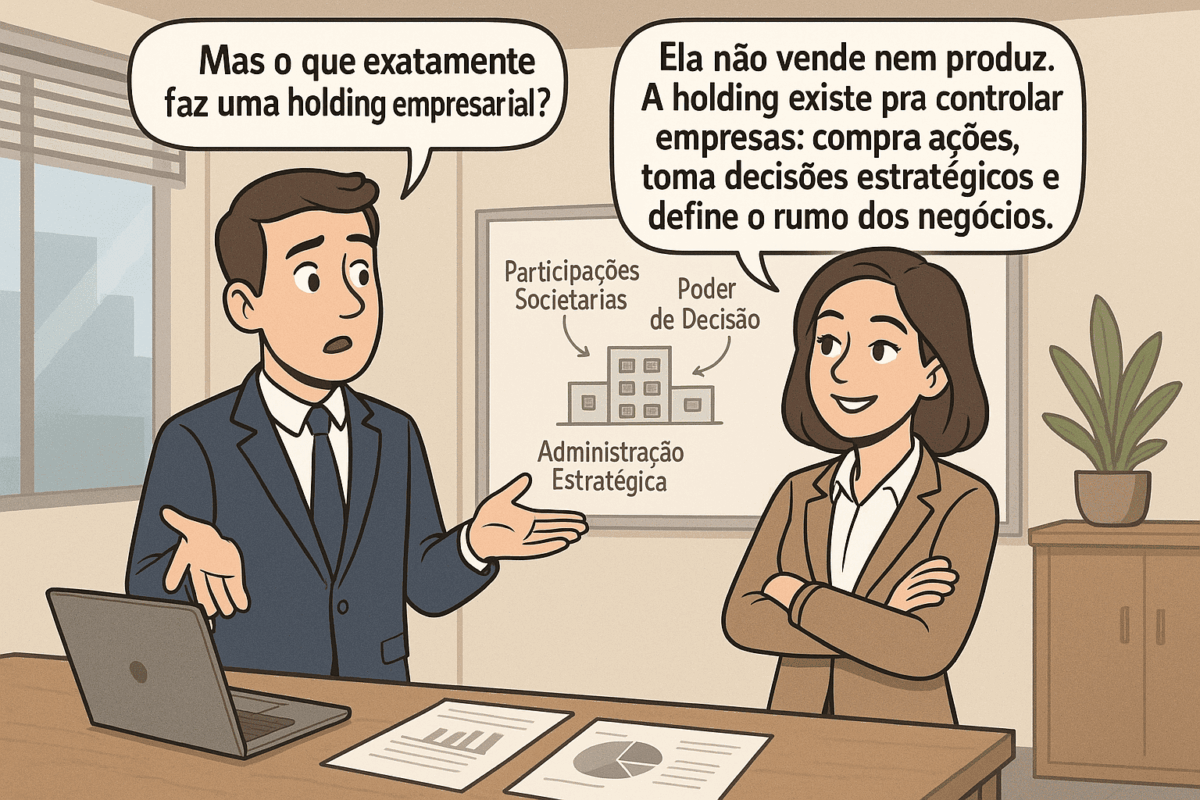

One corporate holding does not provide operational services or produce goods in its own name. Its core business consists of:

- Ownership of shareholdingsacquisition of quotas or shares in controlled companies.

- Exercise of decision-making powervoting rights and appointment of directors in subsidiaries.

- Strategic managementdefinition of investment policies, mergers, acquisitions and disposals.

This model separates the role of shareholder - exercised by the holding company - from the day-to-day operations of the controlled companies, concentrating high-level decisions in the hands of the holding company's partners.

Types of holding company

Although the concept is unique, there are variations in the configuration of types of corporate holding company:

- Pure holding company: It is intended exclusively to hold stakes in other companies, without any operational activity.

- Mixed holding: In addition to controlling other companies, it can also carry out its own activities, such as property management or consultancy services.

- Financial holding companies: Specialized in acquiring and managing equity stakes in financial institutions, subject to Central Bank and CVM rules.

The choice of the type of holding company depends on the business objectives, the size of the group and the activities to be carried out.

Steps to set up a holding company

Now that you know what a holding company is and what benefits this type of structure can offer, check out what it takes to set up a holding company:

1. strategic planning

- Map out the companies to be controlled and assess the market value of their holdings.

- Define the main objectives: succession, protection, expansion or fundraising.

- Analyze the feasibility of a pure holding, mixed or financialconsidering incorporation costs, regulatory obligations and the necessary governance.

2. drawing up the articles of association or statutes

Include detailed clauses:

- Corporate purpose (shareholdings);

- Share capital and form of payment;

- Management powers and decision-making quorums;

- Rules on entry, exit and succession of partners.

3. registering with the Board of Trade and obtaining a CNPJ

Draft the social contract in Board of TradeIf you are issuing invoices for your own services as a mixed holding company, obtain a CNPJ from the Federal Revenue Service and register with the state and municipal authorities.

4. capitalization

- Transfer the quotas or shares of controlled companies to the corporate holding company.

- Describe the contribution in the articles of association and arrange contractual amendments or share transfer registrations.

Main risks and precautions when managing a holding company

Despite the benefits, corporate holding requires attention:

- Rigorous due diligence: Evaluate hidden liabilities before contributions;

- Asset valuation: Use technical reports to define fair market value;

- Contract updateAdapting the social contract to legislative and strategic changes;

- Accessory obligations: Keep SPED, DCTF and other declarations up to date to avoid fines;

- Conflict management: Provide for mediation and arbitration clauses in the articles of association.

Mitigating these risks depends on expert legal and accounting advice, as well as robust governance.

Conclusion

Now that you have an in-depth understanding of how a corporate holdingThe company has realized that this structure offers significant advantages in terms of strategic management, asset protection, tax and succession planning.

However, setting up and operating a holding company requires detailed planning, well-drafted contracts, effective internal controls and sound governance practices.

If you want to structure or improve your corporate holding company safely and efficiently, check out the services of CLM Controller Accounting.

Our team of experts is ready to support you from initial planning to ongoing management, ensuring that your holding company is a solid pillar for the growth and protection of your business group.

Get in touch and find out how we can help!