Tax reform is one of the most discussed topics in Brazil's economic and political landscape. Recently, the Senate approved the basic text of the reform regulation, which marks a significant transformation in the Brazilian tax system.

This article presents the main points of this change, the next steps and the expected impact on companies.

What will change with the Tax Reform?

The tax reform proposal approved by the Senate aims to simplify Brazil's complex tax system by replacing five current taxes:

- ICMS (Tax on Circulation of Goods and Services)

- ISS (Tax on Services)

- IPI (Tax on Industrialized Products)

- PIS (Social Integration Program)

- Cofins (Contribution to the Financing of Social Security)

To replace these taxes, the following will be created two new taxes that will form a model of Dual VAT (Value Added Tax):

- Contribution on Goods and Services (CBS): Under federal jurisdiction, it replaces PIS and Cofins.

- Goods and Services Tax (IBS): Under state and municipal jurisdiction, it replaces ICMS and ISS.

In addition, the Selective Tax (IS)This is known as the "sin tax", which will be levied on products that are harmful to health or the environment, such as cigarettes, alcoholic drinks and polluting fuels.

Se você é empreendedor, contador ou só quer fugir de surpresa no imposto, dá o play agora.

Rates and benefits

The definition of tax rates is one of the central points of the tax reform. Check out the main highlights:

- Standard rate: It is estimated that the combined rate between CBS and IBS is around 27.97%. This is one of the largest in the world, but it is designed to keep the tax burden neutral.

- Reduction for Specific Sectors: Sectors such as health, education, sanitation e tourism will have reduced tax rates. Essential medicines, such as those used to treat diabetes, will be exempt from taxation.

- Basic food basket: Essential products such as rice, beans, bread and meat will have zero rate to ensure a lower impact on low-income families.

Cashback for low-income families

One of the most important new features is the cashbackwhich aims to return part of the taxes paid by low-income families. People registered with CadÚnico with an income of up to half the minimum wage will be entitled to a refund of taxes paid:

- Accounts electrical energy

- Accounts water

- Internet

- Cooking gas (13 kg canister)

This measure seeks to make the system fairer by reducing the tax burden on the most vulnerable sections of the population.

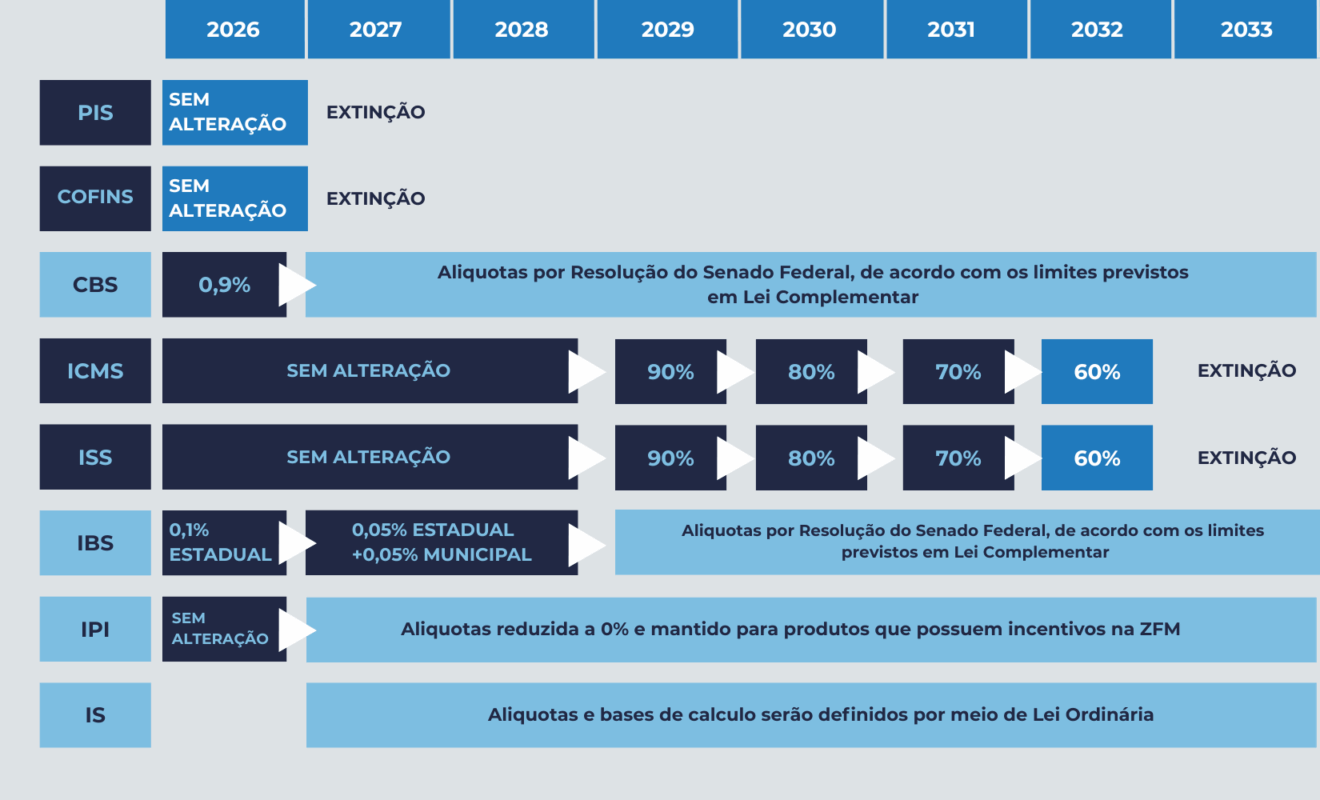

Implementation schedule: gradual transition By 2033

The tax reform will not come into force immediately. There will be a transition period for companies and public administrations to adapt:

This gradualness is essential to avoid abrupt impacts on the economy and to allow companies to reorganize their tax and operational processes.

Impact of the Tax Reform on companies

Tax simplification is one of the main promises of the reform. Check out the expected impacts on companies:

- Reducing bureaucracy: With the unification of five taxes into two main ones (CBS and IBS), companies will be able to significantly reduce the time spent calculating and paying taxes.

- Tax Neutrality: The tax burden is not expected to increase. However, sectors with a history of tax incentives may face adjustments.

- Transparent billing: IBS and CBS will be charged at destination, i.e. at the place of consumption, making the system more transparent and fair.

- The need to adapt: Companies will need to revise their tax and accounting systems to adapt to the new model. This includes new rules for invoices and the calculation of added value.

See also: Companies must promote mental health at work by 2025

Challenges and expectations

Despite the progress, the tax reform still faces challenges:

- Definition of rates: The combined rate can impact the competitiveness of some sectors.

- Tax Exceptions and Benefits: Pressure from specific sectors could complicate the proposed simplification.

- Gradual implementation: The long transition can create uncertainty for companies in the short term.

On the other hand, there is a positive expectation that the reform will bring more efficiency, tax justice and a more favorable business environment.

How CLM Controller can help your company

With the tax changes underway, having a specialized accounting consultancy is essential to avoid risks and ensure compliance. CLM Controller offers:

- Tax accounting: Accurate calculation and optimization of the tax burden.

- Financial management: Efficient control of financial processes for greater profitability.

- Payroll: Automated and secure operations, with legal compliance.

Our specialized team ensures that your company is prepared to face the changes of the tax reform safely and efficiently.

Contact us now and find out how CLM Controller can optimize the management of your business!