PEC 110, also known as PEC da Reforma Tributária 2022, is currently in Congress. The proposal aims to simplify the tax system by replacing five taxes (PIS, Cofins, IPI, ICMS and ISS) with the Goods and Services Tax (IBS). In addition, the proposal creates the Federal Selective Tax, which will be levied on goods and services whose consumption is to be discouraged, such as cigarettes and alcoholic beverages.

Amid the expectation of so many changes, it's interesting to know which changes might be approved and when they will actually come into effect. In this article, we present the answers to these and other questions. Read on and find out more.

READ ALSO: LGPD IN FORCE: WHAT NOW?

What will change with the 2022 Tax Reform?

Let's take a look at the main changes planned for the Tax Reform.

Income tax reform

Among the main provisions of law 3.887/2020, we have:

Adjusting the personal tax table

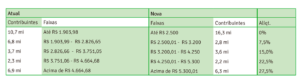

Among the main provisions of the income tax reform is a significant adjustment to the IRPF rates. As we can see in the table below, those earning up to two minimum wages will benefit from exemption. We can also see discounts in the following income brackets.

Fall in corporate income tax

Companies are one of the biggest beneficiaries of the income tax reform. This is because the IRPJ rate fell by seven percentage points (15% to 8%), while the Social Contribution on Net Profit (CSLL) fell by 1%.

Taxation of Profits and Dividends distributed in the 2022 Tax Reform

The exception to the rule is profits and dividends distributed by companies that are part of the Simples Nacional regime and by companies that opt for the presumed profit regime and have a turnover of up to R$ 4.8 million.

Dividends of up to R$ 20,000 distributed by small businesses and between members of the same business group also benefit from the exemption.

Change in taxation on investments

Currently, closed-ended investment funds allow very wealthy families to postpone paying income tax indefinitely. Therefore, the reform aims to change this scenario by stipulating a deadline for settling the taxes owed by the funds.

The text also provides for an end to the deductibility of Interest on Own Capital (JCP), which is a way of remunerating shareholders that brings tax advantages to companies.

Updating the value of assets

With Law 3.887/2021, citizens will be given the option of updating their property values by paying only 4% of IR on the difference, thus benefiting citizens who want to update the value of their properties, paying much less tax when they sell. Membership and payment of the tax will run from January to April 2022.

Creation of the Goods and Services Tax - IBS

Among the main provisions of the Tax Reform is the creation of the Goods and Services Tax - IBS. This tax would replace nine other existing taxes (IPI, IOF, PIS, Pasep, Cofins, CIDE-Combustibles, Salário-Educação, ICMS and ISS).

The proposal is in line with what is already done in developed countries, which have value-added taxes (VAT). The IBS rate may vary according to each product and service, but it must be the same throughout the country.

According to the Federal Government, the IBS:

- will be national in nature, with a rate made up of the sum of the federal, state and municipal rates; states and municipalities determine their rates by law;

- will be levied on a broad base of goods, services and rights, taxing all utilities intended for consumption;

- production and marketing will be charged for all stages of production;

- will also be non-cumulative;

- will have a mechanism for returning the credits accumulated by exporters;

- instant credit will be granted for the tax paid on the acquisition of capital goods;

- The same applies to any import operation (for final consumption or as an input);

- in interstate and intermunicipal operations, will then belong to the state and municipality of destination;

Unification of PIS/Cofins

PEC 110 also provides for the creation of a so-called "dual VAT". Thus, according to the proposal, the federal government should unify two of its taxes (PIS and Cofins) into the so-called Social Contribution on Operations with Goods and Services (CBS). The states and municipalities, in turn, should likewise create a separate tax, resulting from the unification of ICMS (state) and ISS (municipal).

However, the idea is met with a lot of resistance from the administration of state capitals. This is because, with the increasing digitalization of the economy and the growth of the service sector to the detriment of industry, it would be more advantageous for these entities to maintain the current configuration in which they collect more.

Second stage of tax reform to be postponed to 2022

The income tax reform approved in September 2021 will come into force in 2022. PEC 110, however, is still going through Congress without a consensus on the main points of the proposal.

In short, in 2022, the Senate and the Chamber of Deputies will be in charge of discussing the following topics:

- the new Refis proposal, a program to renegotiate companies' tax debts with discounts on the amounts owed.

- constitutional changes, such as the reform of the state's Tax on the Circulation of Goods and Services (ICMS) and the municipal Tax on Services (ISS).

- Income tax (IR) for individuals and companies, including dividends, a mechanism for distributing profits to shareholders that is currently tax-exempt;

- Tax on Industrialized Products (IPI); and

- The Social Integration Program (PIS) and the Social Security Financing Contribution (Cofins) will be merged into a single contribution with a single rate of 12%. The union of the two taxes will give rise to the Social Contribution on Operations with Goods and Services (CBS).

Did you like the content? CLM Controller can help your company structure its tax agenda, schedule an appointment with our team of consultants!