Many taxpayers look for alternatives when the amount to be paid in the annual adjustment weighs on the budget. For this reason, situations such as "I split my income tax and didn't pay" end up being quite common, especially when unforeseen events affect financial planning.

Those who experience this often wonder what the consequences will be and how they can settle the debt with the IRS.

Although installments are an option that offers more breathing space, failing to pay the installments brings risks that go beyond fines and interest. Knowing what can happen if you lose control of these payments is fundamental to protecting your CPF and avoiding headaches in the future.

In this article, you will understand how the installment payment rules work, what happens when there is a default and what are the ways to resolve the situation before it leads to bigger problems.

How to pay income tax arrears to the IRS in installments

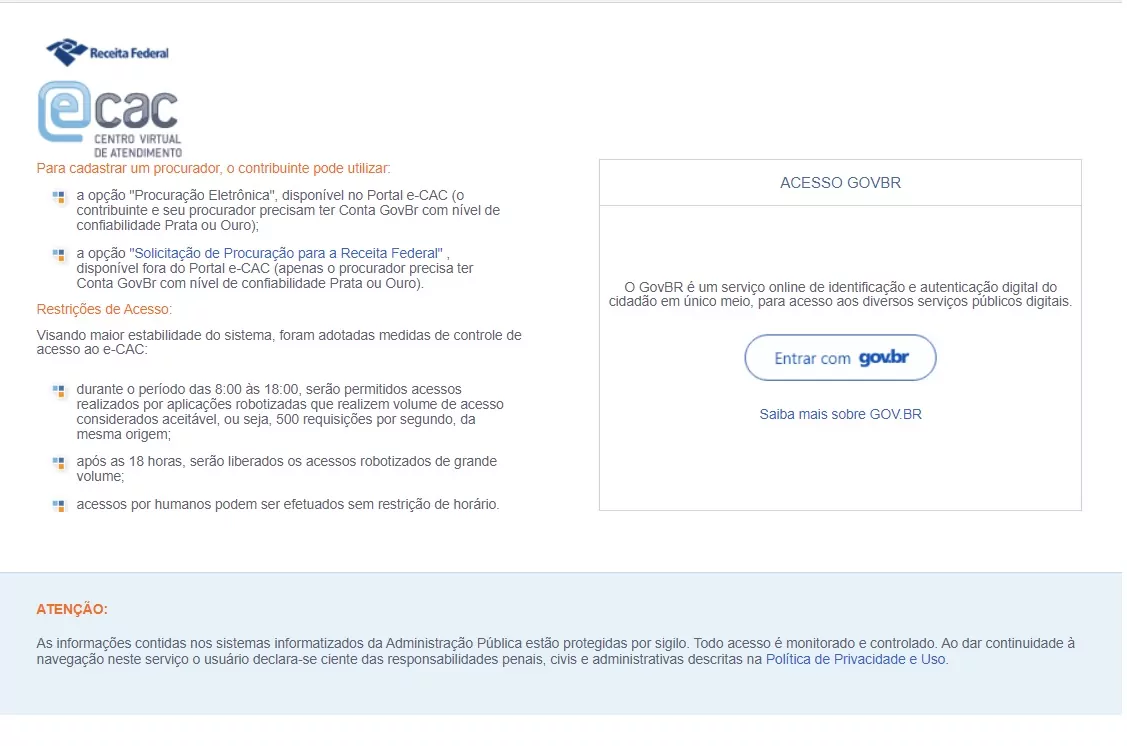

The first step to pay your income tax arrears in installments is to access the IRS e-CAC portal, using the access code or digital certificate.

After logging in, find the "Payments and Installments" option in the menu and then click on "Request Installment Payment". At this stage, you will be able to view all existing debts related to income tax.

The system allows you to simulate the installment payment before it is made. Choose the debt relating to the overdue income tax and click to proceed. O e-CAC shows the installment conditions, including the maximum number of installments available, the minimum amount of each installment and the charges applied.

After the simulation, select the number of installments that best fits your budget, always respecting the minimum amount required by the IRS.

Once the conditions have been checked and defined, confirm the installment payment. The system will generate a Federal Revenue Collection Document (DARF) for the first installment, which must be paid strictly by the due date indicated. The remaining installments will be available monthly, also through e-CAC.

It is worth noting that the installment plan can be requested by both individuals and companies, as long as they have outstanding income tax obligations.

If there are any doubts or difficulties, the recommendation is to seek help from an accountant or specialized companies, ensuring that the debt is correctly framed and that the best payment plan is chosen. Keeping an eye on deadlines and amounts is essential to avoid further complications.

Is there a limit on the number of installments?

Yes, there is a limit to the installment payment of overdue income tax with the Receita Federal. Currently, the maximum allowed is 60 monthly installments, but not all debts can be extended to this limit.

The number of installments available depends on the total amount of the debt, since the IRS sets a minimum amount for each installment. It is essential to analyze beforehand whether your budget can afford this commitment, thus avoiding a new default.

How many installments in arrears do you lose?

Income tax installments can be canceled if three consecutive installments or six alternate installments are late during the agreement. The IRS system also considers non-payment of the final installments to be grounds for canceling the installment agreement, even if the other installments have been paid on time.

In the event of default, the IRS sends electronic or physical notices to alert the taxpayer to the situation.

If the overdue installments are not settled within the indicated period, the installment plan is automatically terminated and the debt returns to full collection status, plus interest and fines due since the original date.

In addition to the loss of the benefit, the debt may be registered as an Active Federal Debt, increasing the charges and making future negotiations more difficult.

That's why it's essential to closely monitor compliance with the agreement and, in the event of any difficulties, look for alternatives before the installment plan is definitively canceled.

I split my income tax and didn't pay: what happens?

Who has ever had to think "I split my income tax and didn't pay it" you need to understand that failure to pay the installments entails a series of penalties and consequences. See below for details of these penalties:

1. interest and late payment penalty

Each installment not paid by the due date is subject to interest based on the Selic rate and a late payment fine of 0.33% per day, limited to 20% of the amount owed. This rapidly increases the total amount owed, making it more difficult to pay at a later date.

2. Cancellation of the installment plan

As mentioned above, failure to pay three consecutive installments, or six alternating ones, will result in the automatic cancellation of the agreement. When this happens, the debt returns to its original status, i.e. it is charged in full, with all legal increases.

3. Registration as an Active Debt

If the installment plan is canceled and the debt remains unpaid, the IRS sends the debt to the Attorney General's Office. At this stage, the outstanding amount is registered as an Active Federal Debt, which has serious consequences, such as an increase in taxes and restrictions on financing and banking operations.

4. CPF restrictions

As long as the debt is active and unresolved, the taxpayer can have their CPF classified as "irregular". This situation restricts the contracting of credit, participation in public tenders, obtaining loans and financing, as well as having an impact on high-value commercial transactions.

5. Possibility of notary protest

In some cases, the debt registered as an Active Debt can be protested at a notary's office, becoming public and bringing even more credit restrictions.

6. Prohibition on issuing negative certificates

Delinquent taxpayers cannot issue negative certificates or positive with negative effect, which are essential for taking part in tenders, transferring goods and obtaining financing.

7. Legal collection actions

The Federal Government can take the taxpayer to court to recover the amount owed, including blocking assets and even seizing amounts in bank accounts. Legal proceedings entail more costs, time and headaches.

LCIs play a key role in real estate financingThis is because the funds raised by the banks via LCI are used for housing loans and real estate operations.

I paid my income tax in installments: How to settle the installments

If the installment plan has been interrupted due to non-payment, it is still possible to find a solution to avoid further complications. Here are the steps to settling arrears:

Access the e-CAC portal

Use your CPF and access code, or digital certificate, to enter the IRS e-CAC environment.

Check the status of your installment plan

In the "Payments and Installments" menu, check whether the agreement has only been suspended for delays or whether it has already been canceled.

Pay the outstanding installments

If you are still on time, generate the updated DARF for the overdue installments and make the payment as soon as possible. This can reverse the default situation and preserve the current installment plan.

Repair the debt if necessary

If the installment plan has been canceled, it is still possible to request a new agreement to repair the debt. However, the debt will revert to the original amount, with all legal increases included.

Seek professional help

If there are any doubts or difficulties accessing the system, it is advisable to enlist the support of an accountant or an experienced accounting firm, such as CLM Controller.

Tips to avoid future problems

Plan to pay the installments, preferably by automatic debit.

Review your monthly budget and anticipate amounts so you don't run the risk of unforeseen events.

Keep all payment receipts organized. If you identify any difficulties, seek professional advice before defaulting. Use financial control tools and a good accountant to monitor deadlines and have more security in meeting your obligations.

Control your income tax and avoid unforeseen events

Negotiating a debt with the IRS only makes sense when there is financial planning to honor the commitment to the end.

Understanding the rules of installment payments, knowing what happens when payments are missed and, above all, acting quickly in the event of any difficulties are essential attitudes to protect your CPF and avoid legal complications.

Take the opportunity to calculating your income tax more accurately using the income tax calculator of CLM Controller.

With this tool, you can anticipate values, simulate scenarios and better plan your budget, avoiding surprises. If you need support to regularize your situation, the CLM Controller team is ready to offer you personalized assistance.

Request a quote and count on those who understand the subject!

Frequently asked questions:

- Is it possible to pay your income tax in installments even if your name is negative?

Yes, the Federal Revenue Service allows income tax to be paid in installments even for taxpayers who have CPF restrictions. However, the recommendation is to regularize any pending issues as much as possible to avoid new restrictions in the future.

- Can I advance the payment of income tax installments?

Yes, you can pay the installments in advance whenever you want. To do this, simply generate the DARF corresponding to the outstanding amount directly through e-CAC.

- Is there a difference between paying personal and corporate income tax in installments?

Although the procedure is very similar, the rules may vary slightly, mainly in the minimum amount of the installments and the availability criteria for certain types of debt.

- Is there a specific period for requesting an installment plan or can it be done at any time?

The installment plan can be requested at any time, as long as the debt is already established and available in the Receita Federal system. There is no period restriction, but delaying the request can increase the amount due due to charges.