Know how to change accountants This is one of the most common questions among entrepreneurs, financial managers, and professionals who depend on clear and reliable accounting information to make decisions.

In many cases, the change of accounting firm occurs due to dissatisfaction with service, lack of proactivity, recurring errors, delays in the delivery of obligations, or simply the need to modernize the company's management.

The good news is that Changing accountants is not complicated., and you can do this at any time, even if there are outstanding tax issues, ongoing proceedings, or ongoing monthly obligations.

The secret lies in following a structured step-by-step process, ensuring that all documentation is transferred correctly, and choosing a new office that will conduct the migration securely.

This comprehensive guide to CLM Controller was created to explain how to migrate the company's accounting with complete peace of mind, without risk, and with minimal effort on the part of the entrepreneur.

If you want to understand how to switch accountants step by step, keep reading. The migration may be simpler than you think.

Why do so many business owners decide to change accountants?

Before explaining how to change accountants, it is important to understand why this need arises. Reasons usually include:

-

- Lack of communication: The entrepreneur sends questions and it takes days (or weeks) to get a response.

- Recurring errors: Incorrectly generated guides, late delivery of obligations, inconsistencies in entries.

- Lack of consulting: The office merely “fulfills obligations,” but does not provide guidance, analysis, or warnings about risks.

- Lack of organization: Lost documents, incomplete reports, unshared access.

- Use of old tools: Absence of dashboards, online reports, or automation.

- Change in the size or complexity of the businessThe company grew, and the accountant was unable to keep up with the demands.

The consequences of poorly executed accounting do not only affect taxes. They affect financial planning, decision-making, corporate organization, and even the company's credibility with banks, public agencies, and investors.

That's why, change accounting firm is often a strategic step toward unlocking growth.

When should I change my meter?

Know how to change accountants It is important, but before that, many entrepreneurs wonder when change really becomes necessary.

In most cases, the decision is not made overnight; it is the result of various signs that appear in the company's daily routine and compromise tax security, financial efficiency, and even business growth.

Here are the main warning signs that indicate it's time to look for a new accounting firm and understand how to migrate company accounting permanently:

1. Lack of feedback and slow communication

If you send a simple question and it takes days to receive a response, this is a clear sign that customer service is subpar.

Accounting needs to partner with the business and offer rapid support, especially in urgent decisions regarding payroll, taxes, or tax issuance.

2. Fines, delays, and recurring errors

Have you received a notification from the IRS? Have you discovered unpaid tax bills? Have you noticed inconsistencies in accounting entries?

These situations are serious and can be costly for the company. This is perhaps the biggest indicator that it is time to understand change accountants step by step and make the exchange as soon as possible.

3. Lack of clarity in reports and absence of consulting

Accounting is not just about fulfilling obligations. It needs to deliver information that aids decision-making.

If reports are incomplete, delayed, or difficult to understand, this hinders management.

4. Company growth without office monitoring

Companies that expand, increase revenue, hire more people, open branches, or diversify their business lines need accounting that keeps pace with the new level of complexity.

If the office continues to operate as if the company were the same size as it was years ago, it is time to review the partnership.

5. Complete absence of technology

Today, exchanging documents via WhatsApp or loose spreadsheets is risky. Modern accounting uses bank integration, management dashboards, tax automation, secure storage, and centralized communication.

If your current office does not keep up with this trend, you lose efficiency and increase the chance of errors.

Can I change accountants at any time?

Yes. That is one of the questions most frequently asked by business owners who are dissatisfied but afraid of change.

The answer is simple: you can change accountants at any time, regardless of the month, quarter, or fiscal year. Even in the midst of monthly obligations, it is entirely possible to carry out the migration.

What you need to know is:

- Accounting old is responsible for obligations until the date of departure.

- Accounting new assumes from the agreed date.

- You are not left “uncovered”: work does not stop between one office and another.

- Tax disputes do not prevent the change—they just need to be communicated so that the new office can take over with clarity.

Changing accountants does not require notification to Internal Revenue Service, Board of Trade or city hall, except in specific cases of companies regulated by professional associations.

In the vast majority of cases, it is sufficient to formalize the termination and grant power of attorney to the new firm.

How to migrate company accounting: a complete step-by-step guide

Now, let's move on to the practical guide that shows how to switch accountants without any hassle.

This is a comprehensive step-by-step guide, following the best accounting migration practices used by modern firms such as CLM Controller.

Step 1 – Read the current contract carefully

Before starting the move, check:

- There is a clause loyalty?

- Is there a minimum stay?

- There is a need for prior notice?

- Are there any outstanding payments?

Accounting contracts do not normally require a minimum term. However, even when they do require advance notice, this period is usually short and does not prevent migration, but merely organizes the transition.

If there are any outstanding financial issues, it is advisable to settle or agree on them before ending the partnership.

Step 2 – Assess accounting, tax, and labor issues

Many entrepreneurs change offices precisely because they discover delays or failures in obligations. Therefore, before formalizing your departure:

- Order one tax status report.

- Confirm if there are any unpaid guides or statements not submitted.

- Check for any accounting inconsistencies.

- Confirm delivery of the SPED, DCTFweb, ECF, ECD, among other obligations.

Even if there are problems, that does not prevent exchange. On the contrary: it is an even stronger reason to seek out a more qualified law firm.

Step 3 – Choose your new accounting firm

This is the most important step.

When choosing where to migrate, consider:

- Specialization in its segment.

- Technical capability of the team.

- Technology used for data integration.

- Transparency and quality of service.

- Submission of reports, dashboards, and strategic analyses.

- Reputation and experience.

A CLM Controller, for example, works with structured onboarding, multidisciplinary teams, and fully digital accounting, ideal for companies that need organization, precision, and continuous monitoring.

Remember: migration is an opportunity to improve, not just to change for the sake of change.

Step 4 – Formalize the termination with your current accountant

After choosing the new office, it is time to officially notify the old one. This notification should be:

- Respectful and objective, indicating the termination of services.

- In writing—letter or email—for record-keeping purposes.

- With clear indication of the end date of the term.

Basic text example:

“Dear Sirs, we hereby inform you that, as of XX/XX/XXXX, we no longer wish to continue with the accounting services. We kindly request that you send us all the documentation, statements, and accesses necessary for the continuity of the accounting.”

This is the step that officially starts the migration.

Step 5 – Request all accounting documents and files

The point that causes the most fear among entrepreneurs is:

“What if the accountant doesn't want to hand over the documentation?”

It is important to know:

→ The accountant may not retain company books, documents, or files.

And you are entitled to receive:

- Statements submitted.

- SPEDs sent.

- Balance sheets and financial statements.

- Contracts, books, and financial statements.

- Labor documents and previous pay slips.

- Passwords and accesses used by the company.

- Digital files (XMLs, reports, integrations).

If there is resistance, the new office can advise on the best way to obtain everything within the law.

Step 6 – Set the migration cut-off date

A cut-off date determines when the old accountant's responsibility ends and when the new accountant's responsibility begins.

It is important to align:

- Who sends the current month's obligations.

- Who processes the current payroll.

- Who generates tax forms.

- Whether there will be reconciliation between periods.

Although many prefer to migrate at the end of the month or year, Changing accountants in the middle of the month is also possible., just agree on what each party is responsible for.

Step 7 – Grant powers of attorney to the new office

In order for the new accountant to access systems and fulfill obligations, it is necessary to:

- Grant electronic power of attorney with the Internal Revenue Service.

- Grant access to city hall, state agencies, or other bodies, depending on the company's activity.

- Revoke previous powers of attorney, when necessary.

This process is quick and can be done digitally.

Step 8 – Begin integration with the new office

Now the accounting really begins. The CLM Controller, for example, performs:

- Initial review of accounting and tax records.

- Check pending items.

- Settlement of overdue obligations.

- Accounting system configuration.

- Integration of documents and operations.

- Configuring reports and dashboards.

- Definition of the company's accounting calendar.

This onboarding period lasts a few days and ensures that the entrepreneur has full visibility from the outset.

Common mistakes you need to avoid when changing accountants

To ensure a safe migration, avoid the mistakes that most harm entrepreneurs:

- Not requesting essential documents: Without documents, the new accountant cannot take over the company properly.

- Do not set a cut-off date: This may result in failures to submit declarations.

- Do not revoke old powers of attorney: This puts information security at risk.

- Hiring a law firm without specialization: Accounting needs to keep pace with the complexity of the business.

- Not communicating pending issues: The new office should start with clarity about what needs to be regularized.

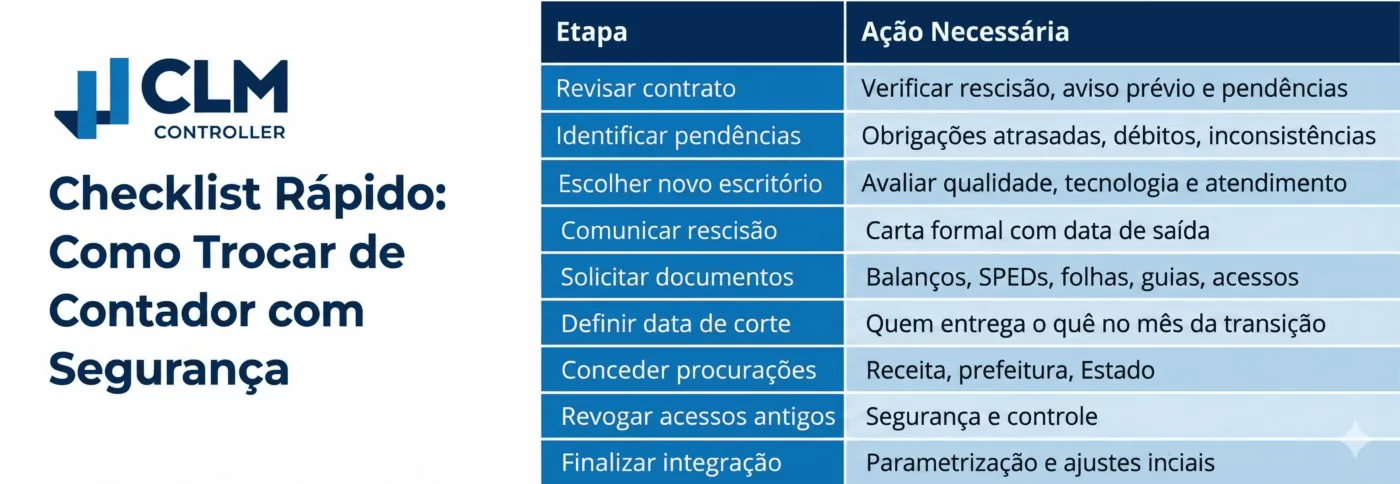

Quick checklist: how to safely switch accountants

By following these steps, you will have a smooth, organized, and risk-free migration.

Why choose CLM Controller to migrate your accounting?

When learning how to change accountants, you realize that the process depends on organization, but also on the right support.

A CLM Controller offers:

- Complete onboarding, taking care of all stages of the migration.

- Multidisciplinary team, with tax, accounting, labor, and financial experts.

- Premium service, direct, fast, and consultative.

- Strategic accounting, with performance reports and close management monitoring.

- Advanced technology, ensuring organization and accessibility of information.

- Regularization and initial diagnosis, ideal for companies that arrive with pending issues.

Our mission is to transform your accounting experience, without bureaucracy, without stress, and with maximum security.

Conclusion

Know how to change accountants is the first step toward raising the level of management in your company.

Changing offices is possible at any time, completely legal, and, when done properly, offers greater security, efficiency, and financial clarity.

Companies that migrate to a better-equipped office experience:

- Risk reduction.

- Better tax planning.

- Access to reliable information.

- Faster and more strategic support.

- More peace of mind in your daily life.

If you feel that your current accounting system is not keeping up with you, not guiding you, or not delivering what it promises, maybe it's time for a change.

And the CLM Controller is ready to conduct this process with care, professionalism, and efficiency.