How to calculate the overdue DAS with Simples Nacional interest?

This article provides practical guidance on calculating Simples Nacional interest on late payments and offers an easy-to-follow guide to accurately calculating DAS interest for your business.

Since the implementation of the simplified tax regime for small businesses, it has been possible to pay several taxes through a single form, the Simplified Collection Document (DAS), thus making your company's accounting easier. However, even with this benefit, your company may face financial difficulties and go into debt with the

Simples Nacional.

Default does not equate to tax evasion

It is essential to understand that delaying the payment of taxes is not to be confused with tax evasion or tax avoidance, which are criminal practices punishable by law.

Law No. 8.137/1990. Delinquency refers to administrative non-compliance with tax obligations and is not considered a crime, unlike evasion

evasion. The law defines acts such as omitting or making false declarations, evading tax inspection, falsifying or altering tax documents or refusing to issue an invoice as crimes against the tax order. In addition, failure to comply with the legal obligation to pay taxes or social contributions also constitutes a crime against the tax order. However, lawyers such as Miguel Teixeira Filho warn of possible confusion in the interpretation of these regulations, which could result in unfounded criminal charges against taxpayers who simply failed to pay the taxes due due to a financial deficit.

Consequences of late payments

According to Brazilian legislation, failure to submit the DAS on time results in a fine of 2% per month on the amount of taxes reported, even if they have been paid in full. In addition, a flat fee of R$ 100 is charged for each group of 10 pieces of incorrect or missing information in the company's records. For this reason, it is crucial to pay attention to the regularity of tax document submissions.

Simple National Interest in arrears

Simple national interest is calculated based on the rate established by the federal government for each billing period. To calculate this interest on overdue Simples Nacional amounts, follow the steps below:

Determine the amount owed: Identify the amount that is in arrears with the Simples Nacional payment. This is the amount on which the national simple interest will be calculated.

Apply the interest rate: Consult the official federal government tables or the

Federal Revenue Service (SRF) to find the current national simple interest rate. Apply this rate to the amount due calculated in the previous step.

Calculate the days in arrears: Count the total number of days between the original payment deadline and the current interest calculation date.

Calculate the national simple interest: Multiply the amount owed by the period of delay (in days) divided by the calculation basis established in current tax legislation. The result will be the amount of national simple interest applied to your specific case.

When the DAS is late

If your company has delayed paying the DAS, you will have to pay fines and interest for the period of delay. If you allow the debt to remain unpaid, you run the risk of receiving an Executive Declaratory Act (ADE) informing you of your exclusion from the Simples Nacional regime, a measure that will come into force on the first day of the following year. If you have already paid off the debt, you will have 30 days to file a defense against the decision. If you are still in debt, you will be given the same period to regularize your situation by paying the amounts owed, thus preventing your exclusion from the Simples Nacional regime. It is essential to comply with these obligations in order to maintain your privileges as an opt-in member of the simplified regime.

Steps to regularize your situation

To regularize the payment of overdue DAS, follow these steps:

-Go to the Simples Nacional website and select the "PGDAS-D and DEFIS" option.

-Enter the system using a digital certificate or generate an access code on the link provided, enter your CNPJ, CPF and the security characters requested.

-Fill in the necessary fields to receive an access code.

Select the option "Emit DAS Simples Nacional / 2ª Via Boleto Atualizado" to generate the form with the updated amounts, including interest and fines for late payment.

Print the boleto and pay at bank branches, ATMs or internet banking.

If your MEI has delayed DAS payments, follow these steps

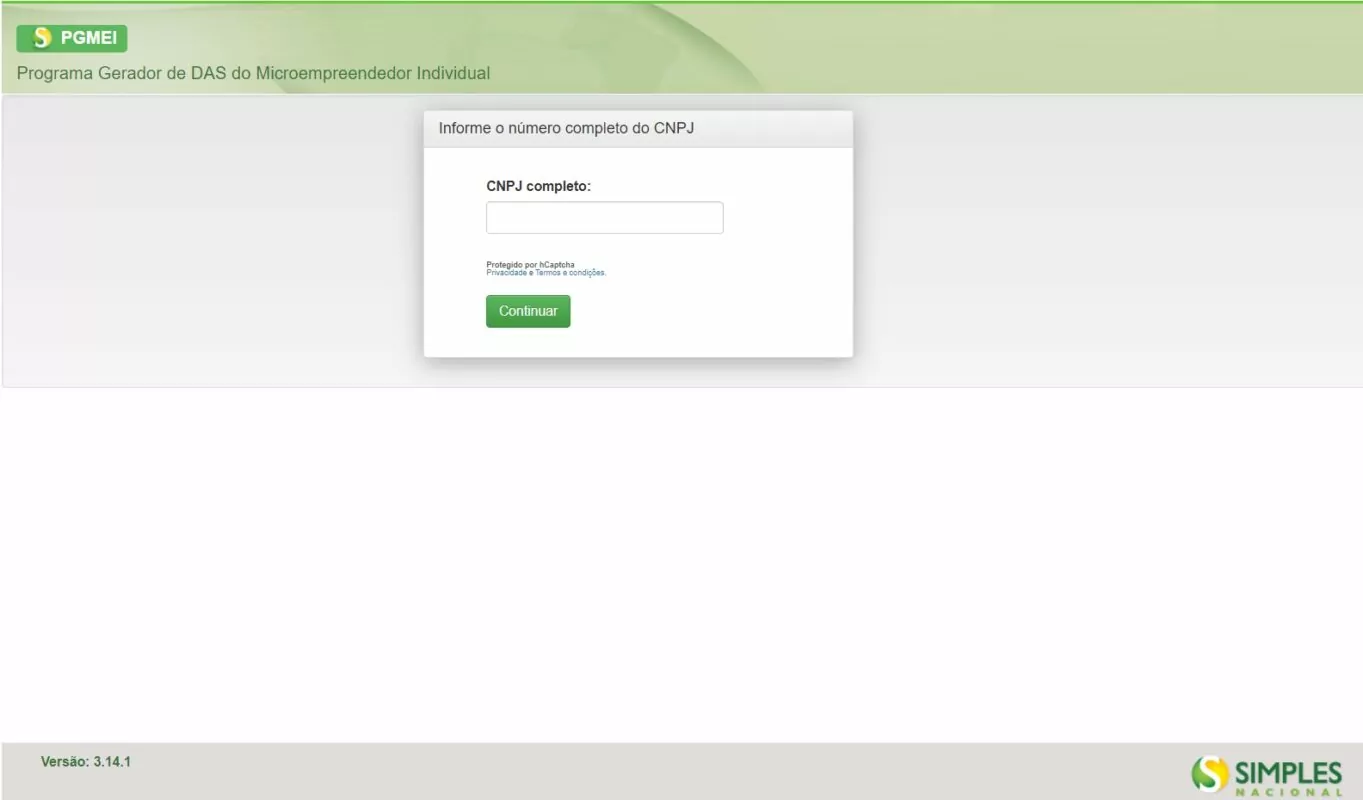

-Access the Individual Microentrepreneur DAS Generator Program (PGMEI).

-Fill in your CNPJ and security characters.

-Choose the year in question and click OK.

-Check the status of your monthly payments, whether they have been settled, are overdue or are close to being due.

-Select the months in which payment is pending and set a new due date.

-Issue the DAS with the updated amounts and make the payment at a bank branch, ATM or internet banking.

Resolve the DAS quickly

In short, calculating simple national interest on arrears and the Simples Nacional Collection Document (DAS) may seem complex at first glance. However, by following the guidelines provided in this article and relying on a partner accounting firm, you will be able to carry out these procedures with precision and ease, thus ensuring compliance with your tax commitments and avoiding possible fines or additional penalties.

CLM Controller specializes in helping companies calculate and regularize overdue DAS. With over 40 years' experience in the market, our team of qualified professionals offers complete support to ensure that you fulfill your tax obligations efficiently and safely.

Spreadsheet

Simples taxes

Spreadsheet

Salary for Days Worked