The theme pro labore vs profit distribution continues to be one of the most discussed among entrepreneurs, business partners and self-employed professionals who have opened a CNPJ to reduce their tax burden.

In 2025, with changes to labor legislation and adjustments to taxation, understanding how to differentiate and balance these forms of remuneration has become essential to guarantee tax savings, legal compliance and the company's financial sustainability.

This comprehensive guide is designed to explain in practical detail how each type of withdrawal works, what the legal obligations are, the tax impacts, as well as comparative calculations and tips for defining the best remuneration strategy.

What is pro-labore?

O pro-labore is the monthly remuneration paid to shareholders who perform administrative, operational or management functions in the company.

In practice, this is a fixed amount, which works in a similar way to the salary of a CLT employee, with a few differences.

Among the main features:

- Mandatory for partners who are involved in the day-to-day running of the business.

- Calculation basis for payment of INSS (20%) and IRRF (when applicable).

- It guarantees social security contributions, generating benefits such as retirement and sick pay.

Therefore, defining the pro-labore is not only a question of tax compliance, but also of the partner's social security planning.

What is profit distribution?

A distribution of profits is the withdrawal proportional to the company's net profit, calculated in the accounts after paying taxes.

Unlike pro-labore, the distribution no INSS or income tax at sourceprovided that the company's bookkeeping is up to date and profits are duly demonstrated.

Difference between pro-labore and profit withdrawal

One of the most common mistakes among entrepreneurs is confusing pro-labore with the so-called "withdrawal of profits". Although both represent forms of partner remuneration, there are important differences.

- Pro-labore: A legal obligation, it functions as a salary, subject to social security contributions.

- Distribution of profits: Optional, depends on positive company results, exempt from direct taxes on the amount received.

In other words, understanding the difference between pro-labore and withdrawal is essential to avoid tax assessments and ensure a balance between social security security and tax efficiency.

Taxation on pro-labore and profit distribution in 2025

The choice between one type or another has a direct impact on the tax burden. Check out the comparative information below:

On the pro-labore:

- INSS Patronal: 20% on the amount paid.

- INSS Partner: 11% deducted from salary.

- IRRF: Progressive table, up to 27.5%.

The distribution of profits:

- Exempt from INSS.

- Exempt from income taxas long as the accounts are in order.

- It depends on proper bookkeeping and income statements.

This is why many entrepreneurs prefer to take out the minimum amount of pro-labore and maximize the distribution of profits. However, caution should be exercised: without a pro-labore, the partner may have problems with the tax authorities and will not have a social security contribution.

How to define the ideal pro-labore

Know how to define pro-labore is a challenge. There is no fixed amount in law, but there are some criteria that all companies need to consider:

- It is recommended that it be compatible with the position held by the partner, so as not to burden the company's cash flow or generate high INSS and IRPF contributions;

- The amount cannot be less than the minimum wage;

- It has to be paid monthly, with the obligatory INSS contribution deducted.

- Partners who have only invested in the business, and who do not carry out any activities in the company, are not obliged to take a pro-labore.

It's worth remembering that a very high pro-labore reduces the profit distribution margin and can generate unnecessary tax burdens.

Comparative table: CLT x Pro-labore x Profit distribution

Check out the comparative table below to understand the real difference between pro-labore and profit distribution:

| Regime | Social Security Contribution | IRRF | Labor benefits | Flexibility |

|---|---|---|---|---|

| CLT (employee) | 8 to 14% (discount) + 20% (company) | Up to 27.5% | FGTS, vacations, 13th, prior notice | Low |

| Partner - Pro-labore | 11% (discount) + 20% (company) | Up to 27.5% | No FGTS, vacation or 13th | Average |

| Partner - Distribution of profits | Exempt | Exempt | No labor benefits | High |

This CLT/PJ comparison table shows that pro-labore guarantees social security protection, but distribution is more advantageous from a tax point of view.

Therefore, the secret lies in balance. Many entrepreneurs choose to receive only 1 or 2 minimum salaries as pro-labore (to guarantee social security coverage and comply with legislation)The rest of the income is made up of profit distributions.

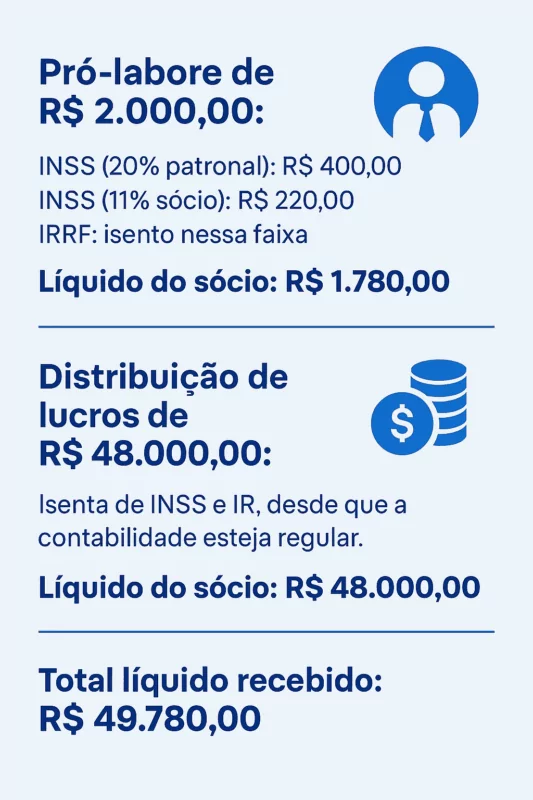

Practical calculation: pro-labore vs distribution

Suppose a company has net profit of R$ 50,000.00 in one month and a managing partner.

This calculation shows that by balancing a minimum salary and prioritizing distribution, the tax burden is optimized.

Therefore, instead of taking a high salary, and thus being forced to bear high social security contribution costs, both employer and personal, as well as IRPF deductions, it is advisable to take a salary close to the minimum and supplement income with profit distributions.

But there is one thing to keep in mind: pro-labore is paid monthly, regardless of the company's results (profit or loss), while profit sharing is only allowed, when the company actually makes a profit.

Benefits of profit sharing

A taxation profit distribution 2025 is exempt from direct taxes for the partner, but requires accounting organization. In addition to tax savings, it allows:

- More efficient financial planning.

- Reinvestment in new projects.

- Higher net profitability for shareholders.

It is therefore essential to maintain bookkeeping and results reports to prove the origin of the profits.

Strategies for balancing profit and distribution

The big challenge for partners is to decide how much to pay out as profit and how much to distribute as profit. Some good practices include:

- Define a salary that is compatible with the job and the market.

- Only distribute profits if the accounts are up to date.

- Evaluate the social security impact of pro-labore to guarantee future rights.

- Carry out simulations with accounting support to find the ideal break-even point.

Common mistakes when defining pro-labore

Here are some common mistakes that all entrepreneurs need to avoid when defining their pro-labore:

- Not paying pro-labore, only taking profit distributions;

- Set symbolic values, but below the current minimum wage;

- Distributing profits without formal bookkeeping.

- Do not transfer the pro-labore amount to your personal account, using the company account to pay for personal expenses.

These practices can lead to assessments, fines and even labor and social security problems.

Pro-labore vs profit distribution in 2025: what to expect

The expectation is that, over the next few years, there will be greater supervision of the receipt of pro-labore and the withdrawal of profit distributions.

A Internal Revenue Service is increasingly integrated with municipal and state systems, as well as the banking system, thus expanding its capacity for cross-checking data.

With this, it will be even more important for entrepreneurs to be clear about the difference between pro-labore and withdrawal and keep organized records.

Conclusion

The debate pro labore vs profit distribution is not just a technical question, but a strategic one. The correct choice between one modality and another has a direct impact on the tax burden, the financial health of the company and the social security security of the partner.

In 2025, the most advantageous path remains balance: a pro-labour compatible with the partner's role and maximizing the distribution of profits, always with organized accounting.

👉 Define the company's ideal remuneration → click here and talk to one of our experts!