Rodrigo and Bea explain what Split Payment is and how this new payment model will impact companies and consumers.

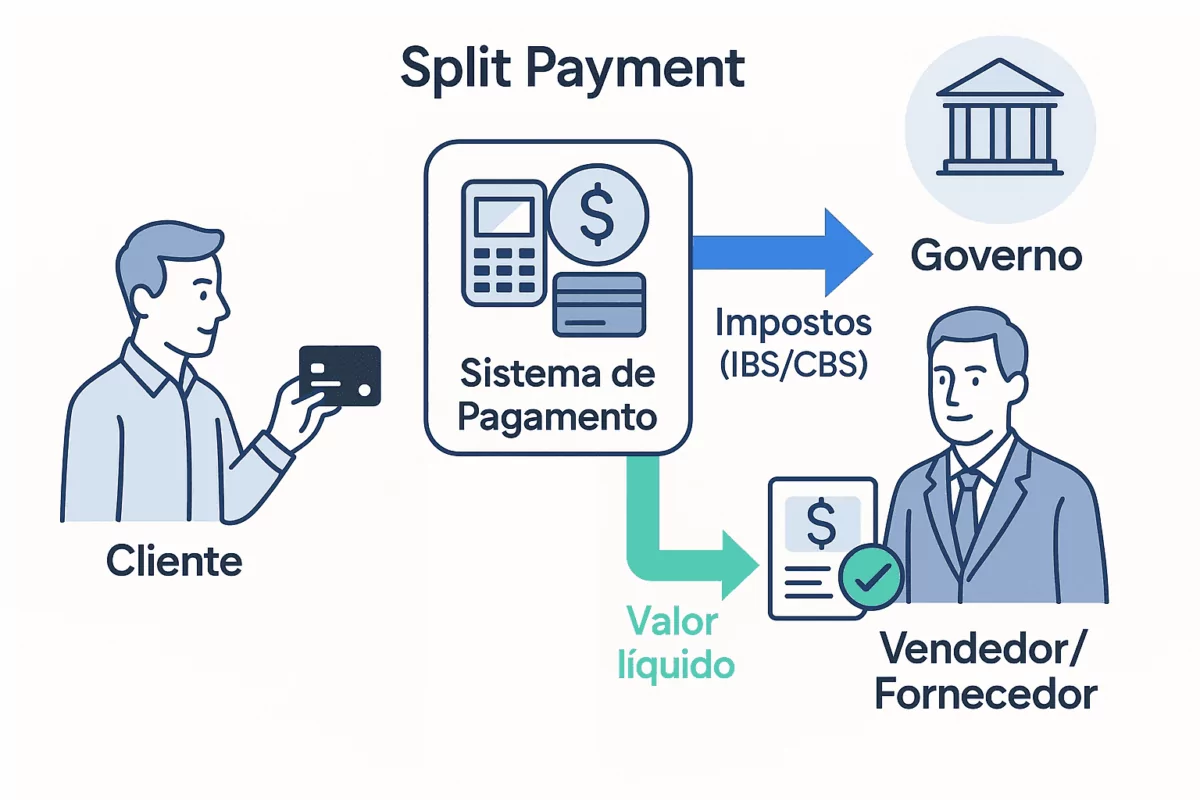

Split Payment (segregated payment) is a new tax collection mechanism introduced by the Tax Reform in Brazil. Instead of the tax on a sale temporarily remaining with the supplier (seller) to be paid later, the tax amount is automatically separated when the purchase is paid for and sent directly to the government.

. Only the net value (excluding tax) is passed on to the supplier of the good or service. This model - nicknamed "Tax pix" - target simplify tax collection and prevent tax evasionThis ensures that consumption taxes are collected immediately and efficiently.

In this comprehensive guide, we'll cover the subject of Split Payment, what it is, how it works in practice and the ways in which it is envisaged, and how your company can plan for these changes.

What is Split Payment?

In simple terms, Split Payment is a way to pay taxes instantly, at the time of the transaction. It works almost like a "payment divider": when you make a purchase and pay by electronic means (such as card or Pix), the payment system already deducts the amount of tax due and sends it to the governmentwhile the rest of the payment goes to the seller.

Unlike the traditional model in which the selling company receives the gross amount and then collects the taxes, Split Payment passes on the taxes automatically, on the flyreducing the risk of default and fraud.

This mechanism was introduced into Brazilian law as part of the Tax Reform. A Constitutional Amendment 132/2023 established the principles of the new tax system, creating the taxes IBS (Goods and Services Tax) e CBS (Contribution on Goods and Services) which replace current taxes (ICMS, ISS, PIS and COFINS).

The Split Payment was legally established for this reform (Amendment 132) e regulated by Complementary Law 214/2025, which details how this segregated payment should take place in practice.

How does it work in practice?

To understand, imagine a purchase of R$ 100, with R$ 18 in taxes built into the price. In a conventional payment, the seller would receive R$ 100 and then collect R$ 18 in taxes from the government on the tax due date. With Split Payment, this transfer is immediate and automated. The basic process works in three stages:

- Invoice issue - The supplier (seller) issues the electronic invoice for the sale, stating the amount of taxes (IBS e CBS) that apply to that operation.

- Payment by the Buyer - The buyer pays for the purchase using an electronic means, such as a credit/debit card, boleto bancário or Pix.

- Automatic division by the payment system - The financial institution or fintech that processes the payment (for example, the card operator or the bank) identifies the data on the invoice and consults the tax authorities' system (Receita Federal/Comitê Gestor do IBS) to calculate the exact amount of tax to pay. Next, this amount of tax is automatically withheld and transferred to the government coffersand only the remainder (net amount) is credited to the supplier's account.

Illustration - In Split Payment, the "payment system" (such as the card company, bank or payment platform) acts as an intermediary: as soon as the customer pays, it separates the tax portion and sends it to the government, depositing only the net amount in the vendor's account. The supplier, in turn, records the tax paid as a tax credit to be used in accordance with the rules of the IBS/CBS.

In practice, the buyer doesn't notice much difference when paying - the final price already includes taxes as normal. The big change takes place behind the scenes: the tax "travels" separately to the government at the moment of paymentwithout going through the cashier of the selling company. This provides greater security for the tax office and promises to reduce tax evasion, since it reduces the possibility of the tax not being collected afterwards.

For companies, the cash flow changes: they will receive the amount of the sale already deducted from taxesBut in return, they will be able to immediately use the tax paid as a tax credit (in the case of companies that are tax payers). IBS/CBSand avoid paying tax again on the same basis).

Legal basis and modalities

The obligation and operation of Split Payment are defined in the Complementary Law 214/2025which regulates the Tax Reform. This law establishes articles 31 to 36, the rules of collection in financial settlement - legal term for this split payment at the time of the transaction.

In short, the law states that electronic payment service providers (such as banks, card operators, fintechs) must segregate and collect the IBS e CBS due when they settle a payment for a transaction involving goods or services. In other words, the responsibility for discounting and passing on the tax was transferred to the payment systemunder the supervision of the tax authorities.

To accommodate different situations, the legislation has provided for three types of Split Payment: o standard (smart), o simplified and manual. Each modality defines who and how the tax will be paid. Below we explain each one objectively:

Smart Split Payment (Standard)

It's the model automatic and integrated. Applies mainly to transactions between companies (B2B)although it can cover other situations with available infrastructure. In this standard mode - called "smart" - the payment systems, connected to the databases of the Federal Revenue Service and the Management Committee of the IBScalculate the exact amount of tax to be paid on each transaction, including tax credits of the supplier.

Thus, it is retained only the tax actually due on that sale, deducting any credit offsets automatically. For example, if on a sale of R$ 100 the tax would be R$ 18 but the supplier already had credit of R$ 2 from previous stages, the system will only be able to collect R$ 16.

This modality requires advanced technology, as it involves consulting the tax authorities' system in real time to verify credits and debits of IBS/CBS. It is the financial institution responsible for the payment that collects the tax hereautomatically. The supplier doesn't receive the amount of tax, but in return he gets a credit for the tax paid. This is considered the ideal model, as it guarantees precision and avoids over or underpayment in the production chain.

Split Payment Simplified

It's a optional and simplified regimedesigned especially for operations in which the buyer no is a contributor to IBS/CBS (i.e. sales to final consumer, B2C(typical of retail). In this modality, instead of calculating the exact tax on each transaction, you use a predefined fixed percentage of IBS and CBS for that sector or type of operation.

This percentage will be defined by the managing bodies (Receita Federal for CBS and the IBS for IBS) and will act as an average. For example, suppose that for a certain branch of retail it has been established that, on average, 12% of the value of sales corresponds to taxes - then with each sale the system retains 12% of the value for taxes, regardless of the specific products.

At the end of the period (month)If the company has collected more than it should by the percentage (because it sold items exempt or with a lower tax rate), it will receive a credit or refund of the excess; if it collected less (because it sold items with an above-average tax rate), it pays the difference to top up. This simplified model facilitates initial implementation and reduces complexity in sectors with a wide variety of products and rates (such as supermarkets, for example).

Who collects remains the payment system (automatically applying the fixed rate defined). The selling company does not have to calculate tax for tax on each sale, but must then check the credits/debits in the monthly settlement. The simplified Split can be used in first years of implementation or until the intelligent system is fully operational for all payment methods.

Split Payment Manual

It is the exceptionThis is used when automatic segregation is not possible at the time of payment. Basically, it applies to payments outside the electronic systemsuch as shopping in cash or check. In such cases, the law allows the buyer who is a IBS/CBS collects the taxes for that operation directly from the government.

It works like this: if a company buys from another company and pays by a non-integrated means (for example, deposit in an account without identification of the invoice, or other instrument without automatic split support), the buyer assumes responsibility for paying the IBS e CBS of that transaction instead of passing the tax on to the supplier.

This manual payment by the purchaser must be made following procedures stipulated by the tax authorities, and the supplier needs to be able to verify that the tax has been paid (there will be mechanisms for this). If the buyer is a final consumer (individual) paying in cash, then there is no way he can collect it directly - in this situation, the tax will probably be collected by the supplier normallyAs is the case today, Split Payment only takes place on electronic media. In any case, cash transactions are likely to become a smaller part of transactions as digital payments advance.

It is important to note that in cases of manual collection (by the purchaser) or any situations in which there is an overpayment of tax, the surplus must be returned to the taxpayer within 3 working days after assessment. This serves to mitigate impacts on companies' cash flow - in other words, if for some reason the system collects tax in excess of what is due, the company will receive it back quickly.

Who pays the tax: the supplier, purchaser or responsible party?

A common question is who, after all, is in charge of collecting the tax for the government in this new model. The answer depends on the type of Split Payment applied in the operation, as we have seen:

VendorIn the old model, it was always the supplier who added the taxes to the price, received the total amount of the sale and then passed the taxes on to the government on the due date. With Split Payment, the supplier no longer collects taxes on most of its sales - this function is now automated by the system or the buyer.

The supplier himself remains the "taxpayer" in formal terms (the person ultimately liable for the tax before the tax authorities), but he doesn't handle that amount at the time of the sale. Instead, he records the credit for the tax paid automatically on the invoice and will use these credits to write off their debts of IBS/CBS in the following calculations. In short, the supplier focuses on its operations, while the tax money goes straight to the government upon payment.

Responsible (financial institution or platform)in most electronic sales, the financial institution that processes the payment is the one that actually withholds and pays the tax - for example, the card acquirer, the boleto bank or the digital wallet/Pix.

These entities are referred to as "taxable persons" responsible for payment at the source. They intercept the financial flow of the transaction and remit the portion of the IBS/CBS directly to the tax authorities, crediting only the net amount to the seller. Important: the law has made it clear that, although these institutions carry out the collection function, they will not be held liable for taxes in the event of default or errors in the information provided by the taxpayer. In other words, if the supplier enters something wrong on the invoice or if the tax is missing for some reason, the blame does not fall on the bank/operator (this protection was important to enable cooperation from the financial sector). For example, in the case of a credit card purchase: the card operator splits the payment, sends part of the tax via the system to the government, and puts the rest towards the commercial establishment.

Purchaserin some specific cases, the buyer will be responsible for collecting the tax. This occurs mainly in the Split Payment manualWhen the payment does not go through any intermediary capable of withholding. If the buyer is a company contributing to IBS/CBSHe must pay the tax on that purchase directly (by issuing the payment slip to the tax authorities for that transaction).

This mechanism ensures that even transactions outside the banking system do not go unpaid. For a individual buyer (ordinary consumer) by paying in kind, the rule of collection by the purchaser does not apply (after all, the final consumer has no way of collecting the tax). IBS/CBS on their own).

In these cases, the operation will probably be handled in a similar way to the old model: the supplier will pay the tax later on that sale, using the traditional procedure (or there may be future regulations encouraging electronic means even for small sales). In any case, the expectation is that most transactions will migrate to integrated electronic means, where automatic Split Payment will take care of collection.

In a nutshell: in Split Payment, the tax money no longer circulates with the seller in most situations. Either it is retained by the payment system (card, bank, etc.) and sent to the government, or (in a few cases) it is paid directly by the responsible buyer.

This change brings greater security for the tax authorities, who collect at source, and forces companies and financial systems to adapt to allow this integration. It is worth noting that if there is any overpayment due to the Split Payment (for example, an estimated calculation above what is due), the legislation provides for the swift return of the excess to the taxpayer, within 3 working days after assessment by the tax authorities. This helps to minimize impacts on companies' cash flow, which will be anticipate the tax at the time of sale but they will have faster compensation mechanisms.

Main articles of Complementary Law 214/2025 and their functions

For those interested in the legal details, the following table summarizes the main articles of the LC 214/2025 related to Split Payment and what each one establishes:

| Article | Which establishes |

|---|---|

| Art. 31 | Establishes collection at financial settlement: in transactions involving goods and services paid for electronically, payment providers must segregate and collect the IBS and CBS amounts at the time of payment. reformatributaria.com Each payment is linked to the respective invoice. (This is the legal basis for Split Payment). |

| Art. 32 | It defines the standard procedure (intelligent split): it obliges the supplier to enter the necessary data (tax amount and transaction ID) on the invoice. The payment system must then consult the tax authorities' system to calculate the amount to be collected, corresponding to the IBS/CBS debits for the transaction minus the amounts already extinguished (credits already used). Before passing the money on to the supplier, the financial intermediary carries out this consultation and separates the tax. It also provides for procedures if the system query fails, ensuring that the tax is still segregated based on the available data. |

| Art. 33 | It provides for the simplified Split Payment procedure: optional for transactions in which the acquirer is not an IBS/CBS taxpayer (i.e. sales to end consumers). Under this regime, the company can choose to apply a predefined fixed rate to collect IBS/CBS on B2C sales, instead of the exact calculation per transaction. This rate will be set by the IBS Steering Committee and the IRS and can be used mainly in the initial implementation phase or by retail sectors, with subsequent adjustments (credit or debit) if there is a difference in the amount due. |

| Art. 34 | It lists complementary rules to Split Payment: (i) payment of the IBS/CBS takes place on the date of payment by the customer (including in installment sales, the tax is segregated proportionally in each installment); (ii) if the supplier advances receivables (for example, discounts trade bills), this does not alter the obligation to segregate the tax on the original date of each payment; (iii) the taxpayer (supplier) remains liable for any remaining balance of tax not covered at source - in other words, if for some reason the split collects less than is due, the company must pay the difference as normal on the regular deadline; (iv) formalizes that payment service providers have the obligation to segregate and collect IBS/CBS in accordance with the rules, but do not become liable taxpayers. (they are not liable for the tax beyond fulfilling the technical operation). |

| Art. 35 | Provides for the implementation of the Split Payment system: determines that the Union (federal government) and the IBS Steering Committee will provide the budget and development of the necessary technological system. It establishes that Split Payment should first come into operation in transactions with non-taxpayer acquirers (end consumers) and in the main retail electronic payment instruments. It provides for a gradual implementation of the mechanism, to be detailed in a joint act by the Federal Revenue Service and the IBS Committee, including the possibility of making its use optional in some cases during the transition. It defines "main electronic payment instruments" as those that are predominant in retail (e.g. cards, Pix). |

| Art. 36 | This allows the purchaser who is an IBS/CBS taxpayer to directly collect the tax due on the transaction if the payment to the supplier is made by a means that does not allow automatic splitting (for example, a method that is not integrated into the system). This is the manual alternative already explained. The article says that if the buyer chooses to collect, he does so by paying the IBS/CBS of the transaction, and then: (i) the amount he has paid will be used to settle the tax due on that transaction; (ii) if he collects an excess amount (above what is due), the extra will be returned to the taxpayer within 3 working days of the calculation. It also stipulates that there should be a monitoring mechanism for the supplier to verify the amount paid by the purchaser. (Note: This article was sanctioned with a veto in one paragraph, and its practical details depend on future regulations, given the complexity of this manual collection). |

Split Payment implementation schedule

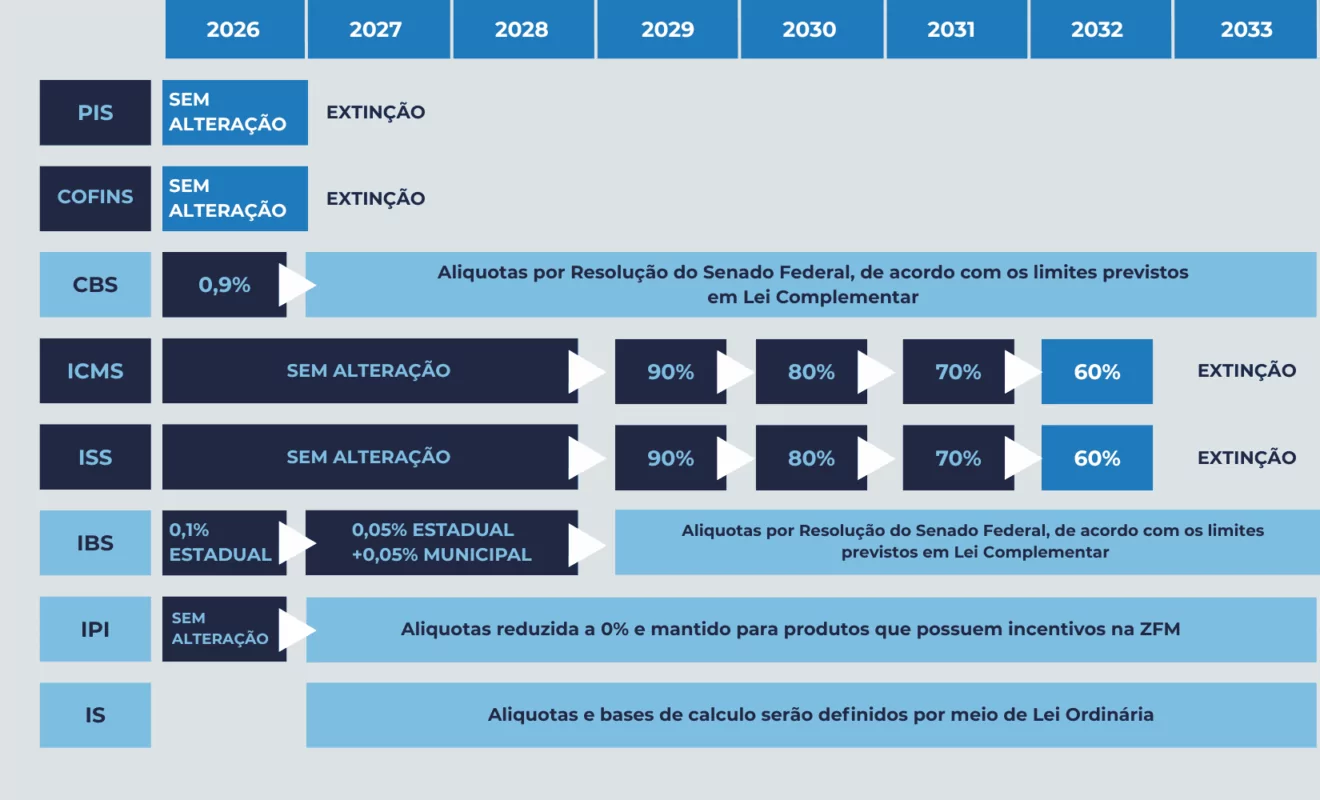

The implementation of Split Payment will take place as follows gradually between 2026 and 2033The transition from the old taxes to the new model of IBS/CBS. According to the Tax Reform timetable:

- 2026: the collection of the new taxes began on an experimental basis (test rates of 0.9% to IBS e 0.1% to CBS). It is expected that the segregated payment system starts operating in a test model in 2026focusing on transactions with end consumers on the main electronic media.

- 2027: entry into force of CBS at a full rate and a progressive reduction in PIS/COFINS. In other words, the CBS contribution replaces federal consumption taxes once and for all, while the IBS state/municipal will still have a reduced initial load.

- 2029: start of the staggered collection of IBSwith a gradual increase in its rate and a reduction in the old ICMS and ISS taxes. From 2029, the IBS will gain a greater share of tax revenue as current taxes are reduced. As a result, Split Payment will also become increasingly present in transactions between companies (B2B), according to the infrastructure smart consolidate.

- 2033: completion of the transition - total extinction of the old taxes (ICMS, ISS, PIS, COFINS and IPI) and full effect of the new system with IBS, CBS and Selective Tax. By 2033, the entire Split Payment mechanism should be fully implemented and comprehensively integrated into payment methods.

During this transition period, the current system and the new one will coexist simultaneously. This means that, especially in the early years, not all operations will use Split Payment immediately - There will be cases in which the old model of monthly calculation will still take place, until implementation is expanded. The law provides for this gradual adoption precisely to allow for adjustments and technological development.

A joint act of the IBS Management Committee and the Federal Revenue Service will define in which stages and sectors Split Payment will be mandatory or optional in the early years. However, it is already clear that sales to final consumers in e-retail will be the system's starting point. Companies should pay attention to the regulatory deadlines that will be set for adapting their billing and collection systems.

Which sectors should prepare first?

Some sectors of the economy will be impacted before others for the implementation of Split Payment, so they should prepare as soon as possible:

Retail and e-commerce:

are priorities in the initial phase. Sales to end consumers in stores, supermarkets, and especially online transactions in e-commerces and digital marketplaces will be among the first to operate with Split Payment.

This is because in these cases the buyer is usually not a taxpayer. IBS/CBSand payments are mostly electronic - the ideal scenario for adopting the model as early as 2026. Marketplaces and digital platforms that mediate sales (such as delivery apps, transportation, product marketplaces) need to adapt, because will be responsible for withholding and passing on the tax if the seller using the platform does not issue an invoice or is not in good standing. In other words, online retail giants and payment fintechs will have to lead the technological adaptation.

Final consumer service companies:

Sectors such as telecommunications, electricity, streaming services, private education and private healthcare (clinics, hospitals) - which charge consumers directly - should also be early adopters of Split Payment. Many of these payments already take place via boleto or card, which makes integration easier. For example, in a telephone or school bill, the tax can be segregated when the customer pays the boleto.

These companies must update their invoicing systems to include the new information required (linking the invoice to the payment, highlighting the tax, etc.).

Financial institutions and card acquirers:

although they are not "sectors" in the sense of trade, it is worth mentioning that payment companies (banks, card operators, fintechs) are at the heart of this new model. They need to develop the tools to identify transactions, consult the tax authorities' databases in real time and split up the amounts.

The success of Split Payment depends heavily on the infrastructure that these institutions implement. Therefore, the financial and payment technology sector has been working together with the government (Central Bank, Revenue) since now. Companies that use their own collection systems (such as large retail chains with credit cards, or fintechs with digital wallets) are also in this group.

Industry and wholesale (B2B):

although the initial focus is on retail and the end consumer, the transactions between companies will also go through Split Payment as the IBS is implemented (mainly after 2029, when the rate of the IBS increase). Industrial sectors, distributors and wholesalers should follow the pilots and, close to the mandatory adoption period in the B2BThey already have their ERPs and systems integrated with the mechanism.

This involves issuing invoices with the appropriate fields and being able to record/reuse credits immediately. So even if the impact is not immediate in 2026, the companies B2B should plan their adaptations in advanceparticipating in tests when available.

In a nutshell, Businesses that sell directly to the end consumer; (especially via electronic payments) are first in line for Split Payment. These sectors should seek guidance and update their processes as early as 2025, in order to enter 2026 fit for purpose. Other segments will have a few more years, but will inevitably also need to join in before 2033. Keeping an eye on the official timetable and sector-specific regulations will be key.

Frequently asked questions about Split Payment (FAQ)

Does Split Payment increase the tax burden?

No. What changes is the way tax collectionnot the amount of tax due. The IBS e CBS will be set to replace current taxes in an equivalent way, so that the effective tax burden tends to remain the same (barring any general changes in the reform).

In other words, the company will pay the same taxesBut more automatically and in advance of sales. This is not a new tax, but rather a new way of collecting existing taxes.

When does Split Payment start?

From 2026 we will already see the Split Payment in action in some operations, initially. According to the law, it will be implemented gradually over the period from 2026 to 2032.

In 2026, it is expected to start in the main retail payment methods, expanding to more sectors in the following years. The full timetable will depend on regulations, but the forecast is that by 2033 all sales covered go through the new system.

Which payment methods will be subject to Split Payment?

Especially the electronic mediacredit and debit cards, bank slips, electronic transfers (TED, PIX) and digital payments in general.

The law mentions the "main electronic payment instruments" in retail, which includes cards and Pix, for example. In short, if the payment involves a financial intermediary or platformthe chances are that Split Payment will apply. As for payments in cash or other non-electronic means do not allow automatic withholding - in these situations, the manual/conventional model will be used (tax collected later by the seller or buyer, as the case may be).

What happens if the customer pays in cash?

In these sales outside the electronic system, there's no way to segregate the tax instantly. Therefore, if it is a cash sale to the final consumer, the procedure will be similar to the current one: the tax levied will be calculated and collected by the supplier later via normal assessment (since the consumer has no tax liability) - in other words, the Split Payment does not occur.

. If it is an intercompany purchase (one company buying from another) and for some reason the payment does not go through an integrated means, the legislation allows the payment to go through an integrated means. buyer (company) collects the tax manuallyThis ensures that the tax authorities receive the amount due. In both cases, ideally these situations will become increasingly rare as more payments migrate to electronic modes with automatic Split.

Will my company need to change systems and invoices?

Yes. Companies will have to adapting your billing, ERP and collection systems to meet the new requirements. For example, the electronic invoice will now contain fields linking each sale to payment and detailing the tax for Split.

Cashiering and sales systems will need to integrate with payment platforms to send this information in real time. It may be necessary to update management software or hire specialized solutions (middleware) that bridge the gap between issuing the NF-e and communicating with the financial intermediaries.

In many cases, the acquirers and banks will provide APIs or modules that companies can add to their systems to make Split Payment possible. It's important to start talking to your accountant or tax systems consultant in 2025 to prepare for these changes.

Curiosities about the Split Payment in the Tax Reform

- "Tax pix": Split Payment got its nickname precisely because it works in a instant and automated. Just as Pix revolutionized fast bank transfers, segregated payment promises to revolutionize the way we pay taxes, making it fast, direct and digital. Every time you swipe your card or pay a boleto, the tax goes to the government as fast as the money goes to the seller.

- Inspired by international experiences: Although innovative in Brazil, the concept of withholding tax at the source of payment has already been adopted in other countries to combat tax evasion. Poland e Italy have implemented versions of split payment in specific VAT transactions (VAT is "European VAT") in order to reduce fraud. A Romania also tested a similar mechanism. These experiments showed advantages in terms of collection, but also technical challenges. The Brazilian model is inspired by them, but on a broader scale and adjusted to our reality.

- Great technological effort: Setting up the Split Payment requires a integration never seen before between public and private systems. The project involves Ministry of Finance, Internal Revenue Service, IBS Steering Committee, Central Bankand all financial institutions and tax software companies. It will be necessary to synchronize invoice issuance, payment mechanisms and tax databases in real time. Systems are being developed to link each invoice to an electronic payment and carry out instant tax calculations with credit verification. In other words, it's a real digital revolution in Brazilian tax administration.

- Transparency and simplification: Split Payment is aligned with other elements of the Tax Reform that seek to more transparency and simplicity. For example, the reform provides for tax cashback (refund of part of the tax) for low-income families, and unification of ancillary obligations in a single national invoice. With the tax being collected on the spot, it is hoped that it will be clearer to the end consumer how much tax is paid on each purchase - and, in the future, refund and demonstration mechanisms can be implemented more easily. There is also the expectation of a reduction in the phenomenon of "tax on tax" ("inside" calculation), since the broad IBS/CBS credit and immediate separation mitigate cascading incidences.

- Reducing the "compliance gap": Currently, a significant portion of consumption taxes end up not reaching the public coffers due to evasion, default or errors - this is the so-called tax compliance gap. With Split Payment, this gap tends to narrow, because hinders tax evasion and non-payment (the tax is paid before anyone even thinks about not paying it). This could represent a significant increase in revenue without raising taxes, just ensuring compliance. Estimates suggest that the tax gap in Brazil is in the tens of billions of reais; recovering part of this would mean more resources for public investment without creating new taxes.

Conclusion - Preparation and specialized support

Split Payment represents a profound change in the way companies deal with taxes on a daily basis. It brings challenges of technological and operational adaptationBut also benefits such as future simplification, less post-sale bureaucracy and a fairer competitive environment (after all, it reduces the advantage of those who used to evade). Faced with this new scenario, it is essential that companies seek to expert guidance to prepare.

A CLM Controller is ready to help your company make the transition from the traditional model to Split Payment. With experience in accounting outsourcing, tax planning, tax compliance e business consultancy, a CLM Controller can take care of the bureaucratic and strategic part while you focus on your business. We help you adapt your systems, reviewing billing processes, understanding legislation and identifying opportunities within the Tax Reform.

Don't wait for change to take you by surprise - contact CLM Controller and find out how our services can ensure that your company is compliant and optimized in this new tax era. You can count on our experts to navigate the new features of Split Payment and the Tax Reform safely and efficiently. Together, we will turn this legal obligation into a competitive advantage for your business. Get ready today and get ahead!