Why pay your debts to the IRS in installments?

For those who have outstanding debts with the Lion due to non-payment of taxes, online installment payments offer an accessible and straightforward solution. Avoiding blockages and financial restrictions, this is a valuable opportunity to catch up on bills and avoid more serious consequences.

Consequences of tax default

In addition to financial penalties such as interest and fines, tax default can lead to a series of restrictions, affecting both individuals and companies. Having your CPF number blocked and your name included in the Credit Information Register are just some of the consequences. For companies, the complications can be even greater, including difficulties in signing agreements and contracts due to a history of being a bad payer. In more serious cases, with arrears of more than 90 days, the company can have its name entered in the Union's Active Debt, resulting in legal collection and even seizure of assets.

Collection period and inter-current statute of limitations

It is important to note that the IRS has a maximum period of 5 years to collect overdue taxes. After this period, the statute of limitations runs out, whereby the agency loses the right to collect the debt in court, but the record in the credit protection agencies remains.

Debt negotiation and installment payments

Negotiating debts with the IRS can be done in installments, with discounts on interest and fines. The process is simple and can be done in up to 60 installments, with amounts starting at R$ 100 for individuals and R$ 500 for companies. For debts already registered in the Union's Active Debt, the agreement process is carried out through the Office of the Attorney General of the National Treasurywith online simulations and formalizations.

pending with the IRS?

You can check your company's tax situation on the Receita Federal website, using the tax situation consultation service. It is also important to maintain regular communication with your accountant, who can help you identify any outstanding issues.

Step by step to check if I have debts with the IRS:

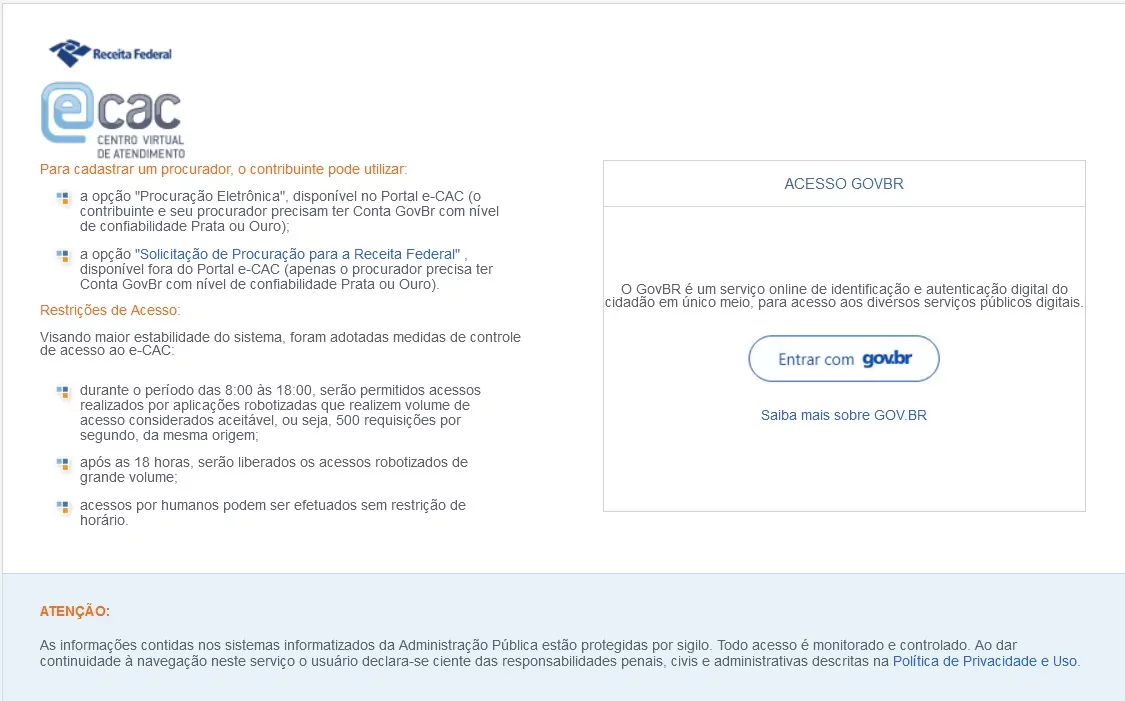

- Access the e-CAC Portal cav.receita.fazenda.gov.br;

- Log in from access with your Gov.br account;

- Click on Consultation Pending - Tax Status in the left-hand menu;

- Then go to Tax Diagnosis on the e-CAC Portal.

What is the deadline for settling my debts before more serious consequences occur?

The ideal is to settle your debts as soon as possible to avoid further complications. The IRS usually offers specific deadlines for joining installment and negotiation programs, so it's important to keep an eye out for communications from the agency.

What documents and information do I need to start the installment payment process?

To start the installment payment process, you will usually need the following documents: CPF/CNPJ, proof of residence, company documents such as articles of association and CNPJ, as well as information on the debts to be paid in installments.

Is it possible to negotiate discounts on fines and interest?

Yes, in many cases it is possible to negotiate discounts on fines and interest by joining an installment program offered by the IRS. Discounts vary according to the program and the payment method chosen.

[Article]: All about INSS for entrepreneurs

How many installments can be made? Is there a minimum amount?

You can pay in installments up to 60 timeswith prices starting from R$ 100 for individuals and R$ 500 for companies. The number of installments and the minimum amount can vary according to the type of debt and the installment program chosen.

Conclusion

In short, the installment payment of debts with the Internal Revenue Service offers an opportunity for tax regularization, avoiding serious consequences and guaranteeing the financial health of both individuals and companies. Don't let debts pile up and jeopardize the future of your business. Take advantage of this affordable alternative and take the first step towards getting your finances in order.