If you're looking to find out how long you have left to retire and want to better understand the INSS transition rules, you've come to the right place!

Below, we'll explain all the details and show you how to use the My INSS and check your contribution time and retirement possibilities.

What are the transition rules?

With the 2019 Pension Reform, the retirement system in Brazil changed, creating so-called "transition rules" to make it easier for those who were already close to retirement to adapt. These rules vary according to each worker profile and are applied to people who were already contributing before the reform.

How to use my INSS to simulate retirement

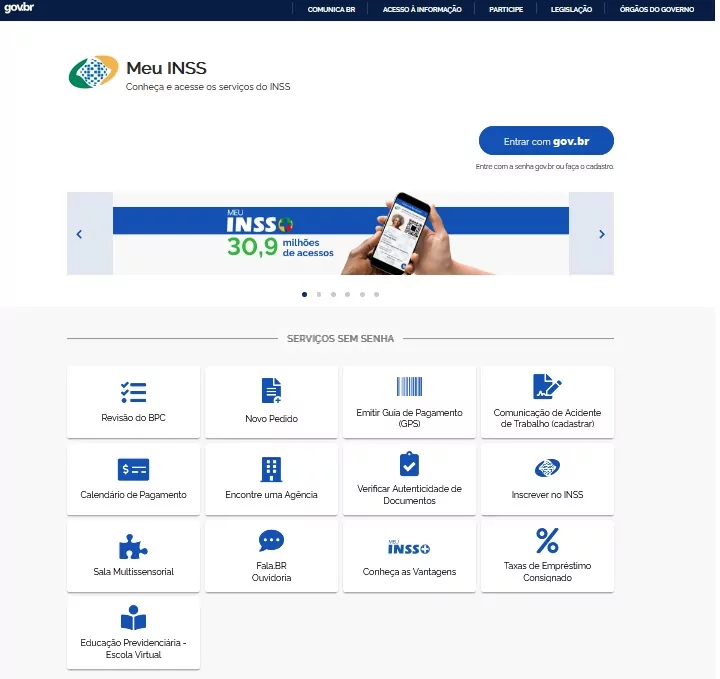

The portal My INSS offers a free simulation tool that helps you understand how much time you have left before your retirement and which transition rule is most advantageous for you. This simulation can be done both on the Meu INSS website and app.

Step by step to check your contribution time

Follow these steps to simulate your retirement:

-

Access My INSS

Enter the official website My INSS or download the app from your phone's app store (available for Android and iOS).

-

Log in

If you don't already have an account, register with your CPF and create a password. This process is free and simple. -

Go to the "Simulate Retirement" option

Within the portal, look for the "Simulate Retirement" option, which will be in the main area or under "Services". -

Check the calculation and remaining time

The simulator will automatically calculate your contribution time and tell you how long you have left before you can retire, showing you all the transition rule options that apply to you. -

Analyze the alternatives

The tool will present the possibilities based on the transition rules, including:- Points systemsum of age and contribution time;

- Minimum Progressive Age: increases every year until it reaches the defined standard;

- 50% and 100% tollsfor those who were close to retiring before the reform.

Main transition rules

There are some main transition rules that may apply depending on your age and contribution time:

- Rule of PointsSum of contribution time and age, and requires 100 points for women and 105 for men.

- 50% tollFor those who were less than two years away from retirement before the reform, it is necessary to pay 50% of the missing time.

- 100% tollYou need to contribute twice as much as you needed to retire before the reform.

- Minimum Progressive AgeIt starts at 56 for women and 61 for men, increasing every year until the final age is reached.

These rules were created so that workers who were close to retirement would not lose their entitlement, and each one is advantageous depending on the individual situation.

Useful links

- My INSS Portal: https://www.meu.inss.gov.br

- INSS Retirement Simulator: Accessible directly from the portal or app.

Read more about: Digital FGTS simplifies payment for employers

Conclusion

Using the Meu INSS simulator is a practical way of understanding your contribution time and what transition rules are available to you. However, planning for retirement goes beyond the simulator: you need to think about tax, financial and social security strategies that maximize your benefits.

To do this, the CLM Controller offers specialized support, helping you to understand and apply the best strategies to ensure a peaceful and planned retirement. With a dedicated team, it advises its clients on transition rules, personalized simulations and other details that can impact their financial future.

Count on the expertise of CLM Controller to achieve a secure retirement in line with your goals.