Accounting outsourcing is a strategic solution that consists of fully outsourcing a company's accounting activities to a specialized provider. By opting for accounting outsourcing, the organization can concentrate its efforts on core activities, while experienced professionals take care of accounting and tax management.

This model, also known as accounting and tax outsourcing or accounting BPO, brings more agility and precision to processes, reducing the risk of errors and increasing operational efficiency.

In addition to reducing internal labor burdens, financial and accounting outsourcing offers access to advanced technologies and up-to-date market practices, without the need to invest heavily in software or staff training.

The benefits of accounting outsourcing are reflected in clearer financial reports, guaranteed compliance with current regulations and scalability as the business grows.

For all these reasons, understanding how accounting outsourcing works and its benefits is essential for companies seeking competitiveness and tax security

What is accounting outsourcing?

Accounting outsourcing is the outsourcing of all a company's accounting activities to a specialized provider, who takes on responsibilities ranging from the tax bookkeeping up to the preparation of financial statements.

In practice, outsourcing accounting allows the organization to transfer routine and complex tasks to a team of specialists, guaranteeing greater precision and constant updating of tax regulations.

This model, also known as BPO accounting what it isThis includes hiring services that replace the need to maintain a complete in-house accounting department.

The provider - often called an outsourced accounting firm - offers software infrastructure, qualified staff and established processes to meet legal deadlines and the requirements of the IRS.

In addition to reducing labor costs and investments in technology, accounting and tax outsourcing brings advantages such as access to up-to-date methodologies and the possibility of scalability as the business grows.

A outsourced accounting company benefits from clearer financial indicators and an improved strategic vision, delegating the complexity of tax calculationsaccessory obligations and accounting adjustments.

How does accounting outsourcing work in practice?

In practice, accounting outsourcing works as a structured partnership between the client company and the accounting service provider.

First, a scope of activities is defined: from routine bookkeeping to ancillary obligations, contracts and closing balance sheets. The organization then provides the provider with the necessary documents (invoices, contracts, bank statements, etc.), usually via a portal or cloud management system.

The outsourced office takes control of entries and data checking, maintaining legal deadlines and issuing periodic reports.

Communication is usually fluid, with monthly meetings to align progress and planning. In this way, the dynamics of accounting outsourcing and tax guarantees well-defined processes, transparency and legal certainty for the company.

Accounting management

A accounting management includes the recording, classification and analysis of all the company's financial transactions.

In the accounting outsourcingThe supplier's team accesses its ERP system or uses its own software to post incoming and outgoing invoices, calculate costs, calculate depreciation and carry out bank reconciliations.

In addition to guaranteeing accounting complianceThe provider automatically updates the chart of accounts and settles income and expenses in accordance with the rules of the Accounting Pronouncements Committee (CPC).

With this, you get organized accounting ready for statements such as the balance sheet and income statement, making decision-making easier.

Fiscal management

In fiscal managementThe main objective is to meet tax obligations and reduce the risk of assessments. The supplier prepares and sends tax payment forms (ISS, ICMS, PIS, COFINS, IRPJ, CSLL etc.), makes monthly calculations, calculates tax regimes (Simple, Presumed or Real Profit) and generates electronic declarations (SPED Fiscal, EFD Contributions, DCTF, DIRF).

To outsource accounting departmentThe company transfers responsibility for any rectifications and clarifications with the tax authorities to the partner, as the provider acts as a proxy in the electronic processes. This service reduces rework and avoids fines for delays or incorrect information.

Payroll

The payroll in financial and accounting outsourcing includes the complete preparation of salaries, charges, benefits and labor provisions.

The partner calculates salaries, 13th, vacations, FGTS, employer and withheld INSS and generates social-tax forms (GPS, GFIP, e-Social). It also issues employee receipts, personnel cost reports and provisioning spreadsheets.

In the event of admissions, dismissals or contractual changes, the provider does all the necessary registration and homologation. By choosing the BPO accounting what it isThe company gains confidence that its labor obligations are correct, avoiding legal liabilities.

Accounts payable and receivable

As part of accounts payable and receivableThe outsourced office manages invoice shipment, payment approval and receivables control. Authorization flows are established for settling expenses and issuing charges.

The partner generates invoices and collection instructions, performs automatic bank reconciliation with accounting entries and updates the balance of each customer and supplier.

The result is a accounting outsourcing benefits in accelerating the cash cycle and reducing defaults, as the provider uses average payment and receipt period indicators to suggest improvements in financial flow.

Issuing accounting and financial reports

The issuing accounting and financial reports provides customized management analyses.

The provider generates income statements (DRE), balance sheets, projected cash flows and key performance indicators (KPIs) such as profit margin and stock turnover. There are interactive dashboards in the cloud, allowing managers to monitor metrics in real time.

With the accounting outsourcing how it works integrated with BI tools, the company has up-to-date information to plan investments, cost cuts and growth strategies. This service transforms raw accounting data into actionable insights.

What are the advantages and benefits of accounting outsourcing?

The adoption of accounting outsourcing brings a series of strategic and operational advantages to companies of all sizes. By opting for accounting outsourcingThe organization transfers routine and complex tasks to a specialized partner, reducing internal costs and the risk of non-compliance.

The adoption of accounting outsourcing brings a series of strategic and operational advantages to companies of all sizes. By opting for accounting outsourcingThe organization transfers routine and complex tasks to a specialized partner, reducing internal costs and the risk of non-compliance.

In addition, the accounting and tax outsourcing provides access to professionals who are up-to-date with the constant changes in tax legislation, without the burden of training or layoffs.

This outsourced accounting company promotes a balance between cost and quality and generates more accurate and timely reports, providing valuable information for decision-making.

Cost reduction (less internal labor charges)

One of the main advantages of accounting outsourcing is the significant reduction in operating costs. When you hire a Accounting BPOThe company eliminates fixed costs for salaries, social security, benefits and the infrastructure of an in-house accounting department.

Outsourcing allows for a variable cost, adjusted to the volume of services required, and avoids expenses with vacations, 13th salary and terminations. This budget optimization frees up financial resources that can be directed towards strategic investments or strengthening cash flow.

In addition accounting outsourcing reduces indirect costs, such as training and the acquisition of management systems, since the supplier already has qualified teams and specialized software.

Access to specialized expertise

Other accounting outsourcing benefit is immediate access to professionals with in-depth knowledge of accounting and taxation.

Specialized offices maintain multidisciplinary teams made up of accountants, auditors and tax consultants, who keep up with updates from the Internal Revenue Service, read technical opinions and take part in continuous training courses.

In this way, the client company relies on consolidated methodologies and best market practices, reducing the chance of errors in entries and declarations. This level of specialization would be difficult to achieve internally without heavy investment in recruiting and developing talent.

Focus on core business

To outsource accounting departmentThe organization frees up its internal staff to devote themselves exclusively to activities that generate direct value for the business.

Without the burden of routine tasks such as bookkeeping, closing balance sheets and calculating taxes, managers and employees focus on sales, customer service, innovation and market expansion. This realignment of priorities increases productivity and allows the company to remain competitive.

The decision on why outsource accounting is often directly linked to the search for greater operational efficiency and the need to concentrate efforts on developing products and services.

Compliance guaranteed

A accounting and tax outsourcing ensures full compliance with accounting and tax regulations. The supplier assumes responsibility for the delivery of ancillary obligations, such as SPED, DCTF, DIRF and ECF, and monitors deadlines to avoid fines and penalties.

Quality procedures and internal audits processes ensure that possible inconsistencies are corrected before they are sent to the tax authorities. This legal certainty is essential for companies wishing to mitigate tax risks and maintain a solid image with clients and investors.

A outsourced accounting company now has robust internal control mechanisms and governance policies that guarantee the reliability of information.

Scalability

The ability to quickly adjust the volume of services is one of the great advantages of accounting outsourcing. In periods of growth, mergers or acquisitions, the specialized partner resizes the team and infrastructure needed to support the new demand, without the company having to hire new employees or acquire additional software.

Similarly, in times of seasonality or downturn, the cost adjusts to the drop in activity, preserving the budget. This flexibility makes it possible to expand the business with less financial and operational risk, allowing the company to grow sustainably.

Use of state-of-the-art technology without own investment

With the financial and accounting outsourcingWith the help of the latest technology, the organization has access to state-of-the-art management and automation systems without having to invest directly in licenses, upgrades or IT infrastructure.

The partner provides ERP tools, BI and collaboration portals in the cloud, guaranteeing data security and process integration. This speeds up digitalization, improves information control and reduces the time spent on manual tasks.

The company takes advantage of the most modern solutions on the market, optimizing its operations and keeping in line with Industry 4.0.

Continuity of service

Finally continuity is a relevant benefit of accounting outsourcing how it worksEven when the supplier's employees are absent due to vacations, leaves or any unforeseen circumstances, the team maintains the service without interruption.

Contingency plans and rotation of professionals ensure that deadlines are met and that accounting routines are not interrupted.

The client company doesn't have to worry about emergency replacements or information gaps, as the provider maintains a staff of trained professionals and well-documented processes to ensure uninterrupted service delivery.

What are the risks and precautions when outsourcing accounting?

By opting for outsource accounting departmentIt is essential to understand the potential risks and adopt measures to mitigate them.

Even though accounting outsourcing offers many benefits, a hasty choice or lack of attention to contractual and operational details can result in compliance failures, delays, hidden costs and even the leakage of sensitive information.

Therefore, before closing a deal, carefully assess the supplier's track record and reputation, draw up a clear and complete contract, and define communication and quality control processes.

Here are five fundamental precautions to ensure that your company makes the most of the accounting and tax outsourcing safely.

Choosing a reliable supplier

Before hiring a outsourced accounting companycheck the firm's references, cases and certifications.

Analyze whether the provider is registered with the Regional Accounting Council, has experience in your market segment and feedback from current clients.

Search for any sanctions or complaints in consumer protection agencies and on social media. A reputable supplier will have audited quality processes, robust internal controls and staff with proven technical training.

By choosing a reliable supplier, your company reduces the risk of inconsistencies in entries, fraud or failures to submit tax returns.

The importance of a clear contract

A well-drafted contract is the basis for a successful partnership of accounting outsourcing benefits.

It should specify in detail the scope of services (accounting management, tax, payroll, etc.), delivery deadlines, responsibilities of each party, confidentiality policies and penalty clauses in the event of non-compliance. It should also include a definition of values, adjustment conditions, payment methods and termination conditions.

Make sure there are clauses for periodic review and adaptation to changes in the law. A clear contract avoids divergent interpretations and protects your company from financial or legal surprises.

Data protection and confidentiality

In financial and accounting outsourcingAs a result, access to sensitive information is inevitable. That's why you need to make sure that the supplier adopts good information security practices: encryption of data in transit and at rest, access control policies, regular backups and disaster recovery plans.

Make sure there are robust non-disclosure agreements (NDAs) in place and that professionals sign confidentiality commitments. Implementing security audits and vulnerability assessments helps prevent leaks of customer data, transactions or financial statements, preserving your company's image and compliance.

Establish clear service level agreements (SLA)

To ensure that accounting outsourcing how it works work without bottlenecks, define precise Service Level Agreements (SLAs) with clear performance indicators.

- Include metrics such as response time to requests, maximum delivery time for ancillary obligations, allowable error rate and support channels (e-mail, chat, telephone).

- Specify penalties or credits in the event of non-compliance and review these parameters periodically.

Well-adjusted SLAs create aligned expectations between company and supplier, enabling greater transparency and allowing deviations to be corrected quickly before they impact accounting closures or tax obligations.

Ensuring technological integration

One of the pillars of BPO accounting what it is efficient is the integration between your company's systems and the supplier's platforms. Before you hire them, check that they are compatible with your ERP, CRM or financial management.

Plan data migration processes, API definitions and automatic update routines to avoid manual rework.

Technological integration reduces typing errors, speeds up document import and keeps data synchronized in real time. This is especially important for companies that use accounting and tax outsourcingThe agile flow of information ensures more accurate reporting and continuous compliance.

Why outsource your company's accounting?

Outsourcing company accounting goes beyond simply delegating tasks: it's a smart strategy for optimizing resources, gaining agility and ensuring compliance.

By opting for accounting outsourcingIn this way, the organization transfers complex and routine responsibilities to a specialized partner, freeing up the internal team for strategic and growth initiatives.

Below, we list the main reasons why why outsource accounting can transform the financial and administrative management of any business:

- Immediate reduction in fixed costs

Hiring an in-house accounting team requires salaries, fees, training and infrastructure. When outsource accounting departmentThese costs become a variable expense, adjustable according to the demand for services. - Access to multidisciplinary experts

In the accounting and tax outsourcingIf you're a financial analyst, you no longer have to rely on a single person or a small group, but on accountants, auditors, tax experts and financial analysts. Each professional brings experience in specific segments and is constantly updated on regulations and case law. - Focus on core business

Less time and energy devoted to administrative activities and more attention to product development, customer service and innovation. Delegating accounting ensures that your team focuses on what really drives the business. - Scalability without operational complexity

In times of rapid expansion, mergers or seasonality, the supplier increases staff and tools automatically. Without the need to open new positions or buy additional equipment, you can deal with peaks in demand in a fluid way. - Improving processes and technology

Accounting BPO firms invest in automation, management systems and data integration. By adopting financial and accounting outsourcingIf you have a cloud-based portal, your company can benefit from cloud portals, BI tools and real-time reports without having to invest heavily in IT. - Mitigation of legal and fiscal risks

With each change in legislation, the accounting partner updates its procedures and systems. This drastically reduces the chance of fines, assessments and inconsistencies in ancillary obligations - one of the biggest advantages of accounting outsourcing. - Ensuring operational continuity

Even during periods of vacation, leave or staff turnover, the service continues uninterrupted. Contingency plans and backup staff ensure that deadlines are met and that your business is not interrupted. - Improved visibility and control

Customized dashboards and management reports allow you to monitor key indicators such as profit margin, stock turnover and average payment period. With consolidated and up-to-date data, decision-making becomes faster and more accurate. - Contractual flexibility and adaptability

You adjust the scope of services according to specific needs, and can include or remove modules such as payroll, tax management or internal audit. This flexibility is one of the main accounting outsourcing benefits for companies in constant transformation.

In a nutshell, outsourcing company accounting is a strategic choice that combines economy, security and technology.

By adopting the BPO accounting what it isYour organization gains efficiency, reduces risks and is better positioned to take advantage of market opportunities, while always remaining in line with regulatory requirements.

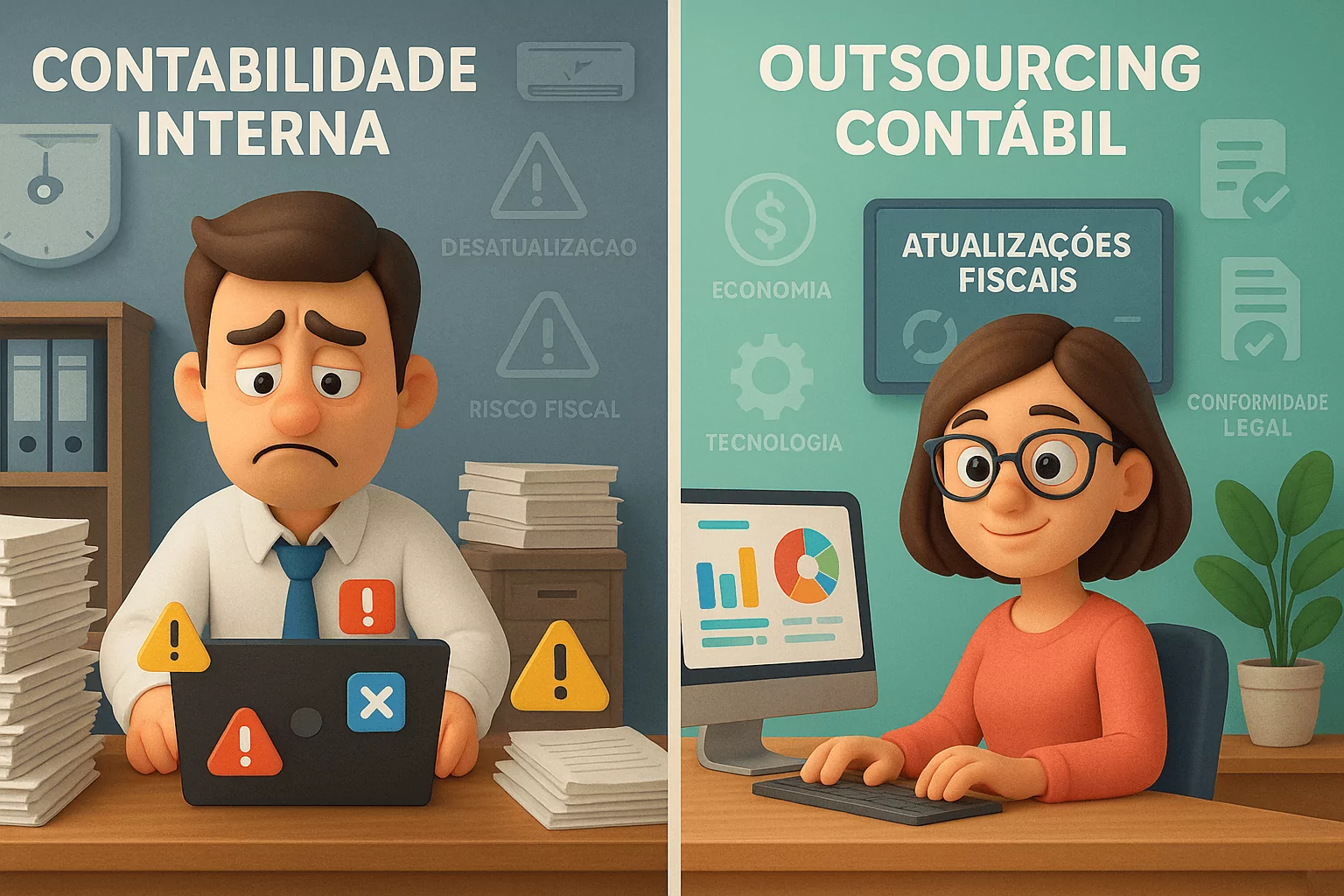

Outsourcing accounting vs. in-house accounting

Compare accounting outsourcing with internal accounting helps highlight why many companies are migrating to an internal accounting model. accounting outsourcing.

In internal accounting, the company maintains its own professionals - accountants, assistants and analysts - as well as paying salaries, labor charges, training and purchasing systems.

In the case of financial and accounting outsourcing, all this effort is shifted to a specialized supplier, who works with a multidisciplinary team, cutting-edge technology and certified processes.

While internal accounting offers direct control over every stage of the process, it can suffer from a lack of backup when an employee leaves, delays in absorbing new legislation and high fixed costs.

On the other hand accounting and tax outsourcing guarantees continuity even during vacations or leaves, flexibility to adjust the volume of services according to demand and immediate access to legal updates - without generating extra expenses for the company.

In addition, specialized offices often invest in automation, dashboards and systems integration, which is not always feasible for internal structures, especially in medium and small companies.

Internal accounting can be interesting for organizations that are highly sensitive to business demands and want to keep all processes under direct supervision. However, this model requires heavy investment in governance, training and IT infrastructure.

In BPO accounting what it isThe partner absorbs these investments, transforming them into a predictable and scalable service.

In practice, the choice between in-house accounting and accounting outsourcing must take into account factors such as the maturity of the accounting process, the volume of transactions, the need for management reports and tolerance of tax risk.

| Aspect | Accounting Outsourcing | Internal accounting |

|---|---|---|

| Cost | Variable expense, excluding labor charges | Fixed costs for salaries and taxes |

| Expertise | Specialized and multidisciplinary team | Internal knowledge limited to the current team |

| Scalability | Quick adjustment of resources as required | Hiring and training take longer |

| Technology | Access to ERP and BI systems without investment | Own investment in licenses and hardware |

| Continuity | Uninterrupted support, contingency plans | Risk of gaps in vacation and sick leave |

| Compliance | Continuous updating of legislation | Updates depend on internal training |

Case study of accounting outsourcing

Imagine company X, a medium-sized industry with 50 employees, which had been using internal accounting for years.

With the increase in the volume of invoices and the requirement for new electronic returns, the accounting department began to face delays, rework and extra overtime costs.

By opting for accounting outsourcingcompany X has migrated its entire bookkeeping, tax assessment and accounting routine to payroll to a specialized partner. In three months, he succeeded:

- Reduce overall personnel and software costs by 30%;

- Eliminate delays in submitting SPED and DCTF, avoiding fines;

- Real-time financial performance reports;

- Directing the internal team in industrial process improvement projects.

In this way, Company X not only improved its operational efficiency, but also gained momentum to focus on expansion, launching new products and attracting investments without accounting worries.

How to choose the right accounting outsourcing partner

Selecting a accounting outsourcing It's just as important to understand the benefits of this model.

The wrong choice can result in operational mismatches, delays in submitting ancillary obligations and even financial losses, even when savings and compliance are sought.

To help you make your decision, we present some fundamental criteria that should guide the evaluation and selection of your partner. outsourced accounting companyThis guarantees a solid, transparent relationship focused on delivering value.

1) Experience and sector specialization

When evaluating potential suppliers, check whether they already operate in segments similar to yours. Companies in specific niches - such as commerce, industry, services or technology - face different tax peculiarities.

A partner with a proven track record in your sector will be familiar with the applicable tax rates, special assessment regimes (e.g. tax substitution or cash regimes), ancillary obligations and market practices.

This expertise reduces learning curves, shortens implementation times and increases the assertiveness of launches.

In addition, consult case studies, customer testimonials and satisfaction indicators to confirm the provider's ability to meet requirements similar to yours.

2 Transparency in pricing and contractual flexibility

Charging models by fixed scope, by transaction or by the hour have different impacts on the budget.

Prioritize suppliers who submit detailed proposals, detailing the activities included, adjustment costs and any additional costs (e.g. opening a branch, sending extraordinary declarations or one-off consultancies).

Check the annual adjustment policy and automatic renewal clauses. Contractual flexibility, such as the possibility of including or excluding modules (tax management), payrollThis is essential in order to adapt the service to the evolution of your business, without generating abusive penalties in the event of a change in scope.

3 Information security and compliance

In financial and accounting outsourcingSensitive data is constantly in transit between parties. Check that the supplier has security certifications, backup policies and encryption both in transit and at rest.

It is also essential that the provider complies with regulations such as the General Data Protection Law (LGPD)guaranteeing consent, anonymization and the proper disposal of files. This minimizes the risk of leaks, fines and reputational damage.

4. support for growth and continuous innovation

Finally, assess the partner's ability to offer innovative solutions, such as process automation, predictive cash flow analysis or tax consultancies proactive.

A good supplier of accounting outsourcing not only performs tasks, but proposes continuous improvements, training and updating processes in line with new legislation and market trends.

Check that the contract provides for six-monthly scope reviews to incorporate innovations and adjust resources, so as to keep the service in line with your business needs.

By applying these criteria, your company will be prepared to choose a partner capable of offering services of accounting outsourcing how it works with a high level of quality, safety and focus on results.

This strategic decision strengthens financial managementreduces risks and maximizes the advantages of the outsourced accounting companyconsolidating a solid foundation for sustainable growth.

Get to know CLM Controller's accounting outsourcing

If your company wants to take advantage of accounting outsourcing benefitsreduce costs and increase the accuracy of your financial statements with the CLM Controller Accounting.

Our team of experts in accounting and tax outsourcing is prepared for:

- Implementing tailor-made accounting outsourcing solutions for your business;

- Ensuring your company's full compliance with the tax authorities;

- Draw up a tax plan to help you pay less tax;

- Offer management reports that are real allies in decision-making;

- Manage your payroll and debt clearance certificates;

- Providing support and advice on the financial management of your business.