Companies taxed by the Real Profit need to consider various taxes in their financial and tax planning, and one of the most relevant in day-to-day activities is the IOF (Tax on Financial Operations). The IOF is levied on operations credit, foreign exchange, insurance and investmentThis affects the cost of these transactions and, consequently, companies' results.

In this article, we clearly explain each type of IOF, their current rates and how they affect Real Profit companies.

Listen now to a special episode of our podcast, in which experts from CLM Controller explain, with everyday examples, how the IOF impacts Real Profit companies

What is IOF and why should companies be concerned?

IOF stands for Tax on Financial Operations, full name "Tax on Credit, Exchange and Insurance Transactions, or Transactions relating to Securities". This is a federal tax levied on both individuals and companies whenever they carry out certain financial operations, such as taking out a loan, making a foreign exchange transaction, taking out insurance or redeeming an investment before a certain deadline. Unlike interest (which is remuneration for capital over time), the IOF is a tax costs which is added to financial operations.

For the government, the IOF has a dual function: in addition to collectionThe IOF, which serves as a source of revenue, is also an instrument of economic policy. Through the IOF, the government can, for example, encourage or discourage certain operations (such as credit or capital outflows) by adjusting its rates. In the business context, especially for Real Profit companies (which are generally larger and have frequent financial operations), the IOF represents an important source of revenue. additional cost that reduces profitability operations and affects cash flow. Unlike some recoverable or compensable taxes, the IOF paid does not generate a tax credit and cannot normally be deducted directly from other taxes, making it an effective financial cost for the company. It is therefore essential to know and consider it in planning - whether when calculating the cost of a loan, assessing the return on a short-term investment or budgeting for foreign operations.

Below, we detail each type of IOF that impacts Real Profit companies, with their current rates, examples and management tips. The information reflects the rules in force in 2025including recent changes in IOF percentages implemented by the government.

IOF on Credit Operations (Loans and Financing)

The credit operations These include bank loans, financing, advances, the use of overdrafts, credit card revolving accounts, among other methods in which the company obtains funds from third parties with a commitment to pay them back later. Whenever a company takes out a loan, IOF is levied on the amount borrowed. This tax is calculated in two ways: one fixed rate applied to the release of credit (percentage of the total amount lent) and a daily rate applied to the value according to the term of the contract.

For companies (legal entities), the IOF-credit rate was recently high. Until May 2025, there was an annual rate equivalent to ~1.88% per year for PJ; now, the effective annual rate has more than doubled to ~3.95% per year.

This annual rate corresponds to the sum of the daily rate over the course of a year plus the fixed additional 0.38%. In practical terms, companies currently pay 0.38% (fixed) on the amount released from the loan, plus approximately 0.0108% per day on the outstanding balance during the term of the contract, totaling around 3.95% if the loan lasts 12 months

Individuals, on the other hand, have a lower daily rate (around 0.0082% per day, ~3% p.a.), but in the case of companies the government has matched or even exceeded this level. Important: Residential real estate credit operations are exempt from IOF, an exception provided for by law.

To illustrate, the table below summarizes the IOF rates on credit operations:

| Track | Revenue in 12 months | Rate | Amount to be deducted |

|---|---|---|---|

| 1ª | Up to 180,000.00 | 4.50% | - |

| 2ª | From 180,000.01 to 360,000.00 | 9.00% | R$ 8,100.00 |

| 3ª | From 360,000.01 to 720,000.00 | 10,20% | R$ 12,420.00 |

| 4ª | From 720,000.01 to 1,800,000.00 | 14.00% | R$ 39.780,00 |

| 5ª | From 1,800,000.01 to 3,600,000.00 | 22.00% | R$ 183.780,00 |

| 6ª | From 3,600,000.01 to 4,800,000.00 | 33.00% | R$ 828.000,00 |

For Real Profit companies, the IOF-credit raises the cost of raising funds and should be taken into account when analyzing the feasibility of financing. It is worth remembering that, although it is a financial expense, the IOF is not a recoverable charge - it leaves the company's cash directly to the government. In tax terms, the IOF paid on credit operations can be accounted for as an expense (reducing real profit and, indirectly, taxes on profit), but does not generate credits to offset against other taxes. In this way, the company effectively bears the cost. When planning, we recommend compare the total effective cost (CET) of credit operations already including IOF and evaluate alternatives: for example, increasing equity, negotiating payment terms with suppliers or other strategies that may avoid the need for short-term credit and its consequent IOF.

IOF on Foreign Exchange Transactions (Entry and Exit of Foreign Currency)

The operations of exchange rate occur whenever the company needs convert currency (reais for foreign currency or vice versa) or moving funds between Brazil and abroad. This includes, for example, foreign currency purchases (for travel or cash formation in hard currency), remittances abroad for paying suppliers or investments, receiving funds from abroad (exports, foreign investments, international loans) etc. IOF-exchange is applied to value in reais of the exchange transaction at the time of conversion.

The IOF rates on foreign exchange vary according to the purpose of the operation, and have undergone recent changes. In general, as of June/2025 the government standardized at 3.5% the IOF rate for the most outgoing foreign exchange transactions of the country. Previously, many of these operations had an IOF of 0.38% or 1.1%, but there has been an increase to 3.5% with the aim of raising revenue and bringing it into line with international rules. The main current exchange rates are:

| Foreign Exchange | IOF rate |

|---|---|

| Buying foreign currency in cash | 3.5% of the value in reais (it was 1.10% until 2025) |

| Remittances abroad (general) | 3.5% over the amount sent (was 0.38% before) |

| Sending funds for investments (abroad) | 1.1% on the amount sent (reduced rate; it was 0.38% and the government even announced 3.5%, but dropped it to 1.1%) |

| Inflow of funds from abroad (general) | 0.38% on the amount received (kept low so as not to burden income) |

| International credit/debit card (spending in foreign currency) | 3.5% on the amount spent (the rate was 3.38% and was readjusted to 3.5%) |

Note: Specific operations may be treated differently. For example, foreign direct investment in Brazil (entry of foreign capital, such as equity investment) remains exempt from IOF so as not to discourage investment. already external loans raised by Brazilian companies had zero IOF when long-term, but since 2025, short-term foreign loans became payable 3.5% of IOF. We recommend checking the legislation in force for specific cases.

In practice, for a Real Profit company, this means that sending money abroad has become more expensive. For example, if the company needs to send R$ 100,000 to pay a supplier abroad or invest in a subsidiary, it will pay R$ 3,500 of IOF on this operation (3.5%). If you buy US$ 10,000 in cash for an employee to take on a trip, and considering a hypothetical exchange rate of R$5.00/US$, he will spend R$50,000 and pay R$ 1,750 of IOF (3.5% of 50 thousand). On the other hand, the inflow of foreign funds is taxed much less: if the company exports and internalizes US$ 100,000 (R$500,000 equivalent), the IOF on the conversion would only be 0.38%, or R$ 1,900This cost is not very significant in the amount received.

From a planning point of view, Real Profit companies should pay attention to the IOF-exchange rate when calculating costs for imports, payments for services abroad and international transfers. With the increase to 3.5%, this tax could represent a considerable additional cost in these transactions. Mitigation strategies the impact may include: grouping payments abroad (reducing the frequency of remittances), studying possible tax benefits in specific operations (for example, there are cases of zero IOF in exchange operations linked to long-term capital inflows, or in certain regulated financial operations), or even keeping part of the funds in foreign currency when permitted, to avoid multiple conversions. It is also important to monitor legislative changes, as the IOF-exchange rate has been adjusted frequently. It is worth noting that, unlike taxes such as IRPJ or CSLL, the IOF paid on foreign exchange transactions not recoverable - it makes up the final cost of the operation and must be absorbed by the company (although in accounting terms it is a deductible expense when calculating the real profit, it does not generate credits to be offset).

IOF on Insurance Transactions

In the case of insuranceThe IOF is levied on the premium amount paid to the insurance company. Every time a company takes out insurance and pays the premium (value of the policy), IOF is charged on that amount. There are different rates of IOF depending on the type of insurance, defined by specific legislation. maximum rate of 7.38%. Most of the property insurance (which cover goods) uses precisely the rate of 7.38%

Now people insurancesuch as life insurance and personal accident insurance, have a much lower tax rate. 0.38% about the award.

There are also intermediate cases: for example, health insurance or private assistance plans usually have an IOF of 2.38%

The following table summarizes the main IOF rates for insurance:

| Type of Insurance | IOF rate |

|---|---|

| Asset insurance (property, e.g. car, business, home) | 7.38% on the premium |

| Life insurance (pure risk) and personal accident insurance | 0.38% on the premium |

| Private health insurance | 2.38% on the premium |

| Contributions to private pension plans (e.g. VGBL with survivor coverage) | 0% IOF on most of it; 5% if contributions > R$50 thousand/month (new rule) |

Note: The rate of 7.38% is the ceiling established in the legislation for insurance operations in general (Decree 6.306/2007, art. 22). The 5% charge on high contributions to life plans with survivor coverage was introduced in 2025 and mainly affects large contributions in social security insurancenot traditional risk life insurance (which follows at 0.38% for risk premium).

Practical example: Consider that a company hires a business insurance (multi-risk) for its facilities, with an annual premium of R$ 20,000. IOF of 7.38% will be charged on this amount, which is equivalent to R$ 1.476 charged in the policy (totaling R$21,476 in disbursements). If the same company were to take out a group life insurance for their employees, paying say R$ 10,000 of total premium, the IOF will be only 0.38%, or R$ 38. We can see that, in property insurance, the IOF represents a significant increase in cost (almost an "extra month" of payment, in the example of business insurance, the tax is equivalent to ~7% of the premium), while in personal insurance the tax impact is low.

From the Real Profit point of view, the IOF on insurance is accounted for as part of the cost of insurance (operating or administrative expense). As such, it reduces the accounting profit and is deductible from the tax base. IR/CSLL (as it is a necessary expense to protect the company), but there is no recovery of this tax - it is an effective cost. Companies should take the IOF into account when comparing insurance quotes (noting whether the price quoted includes the IOF or not) and when budgeting annual insurance costs. There aren't many strategies for mitigating IOF in insurance, since the rate is fixed by product type; however, ensuring that you are only taking out necessary cover avoids paying premiums (and IOF) in excess of what is due. In short, when it comes to tax planning, the IOF on insurance is yet another element in the cost of protecting assets and people, and deserves attention because of its weight, especially in high-value insurance.

IOF on Investments (Securities and Financial Applications)

As part of the investmentsThe IOF is more restrictive: only in short-term fixed income operationsi.e. when the investor redeems a financial investment before 30 days from the date of application. The logic of the IOF-investment is to act almost as a penalty for very short-term investments (less than a month), in order to discourage excessively rapid movements of speculative capital or the use of certain investments as current account substitutes. Therefore, investments held for 30 days or more are exempt from IOF in most cases

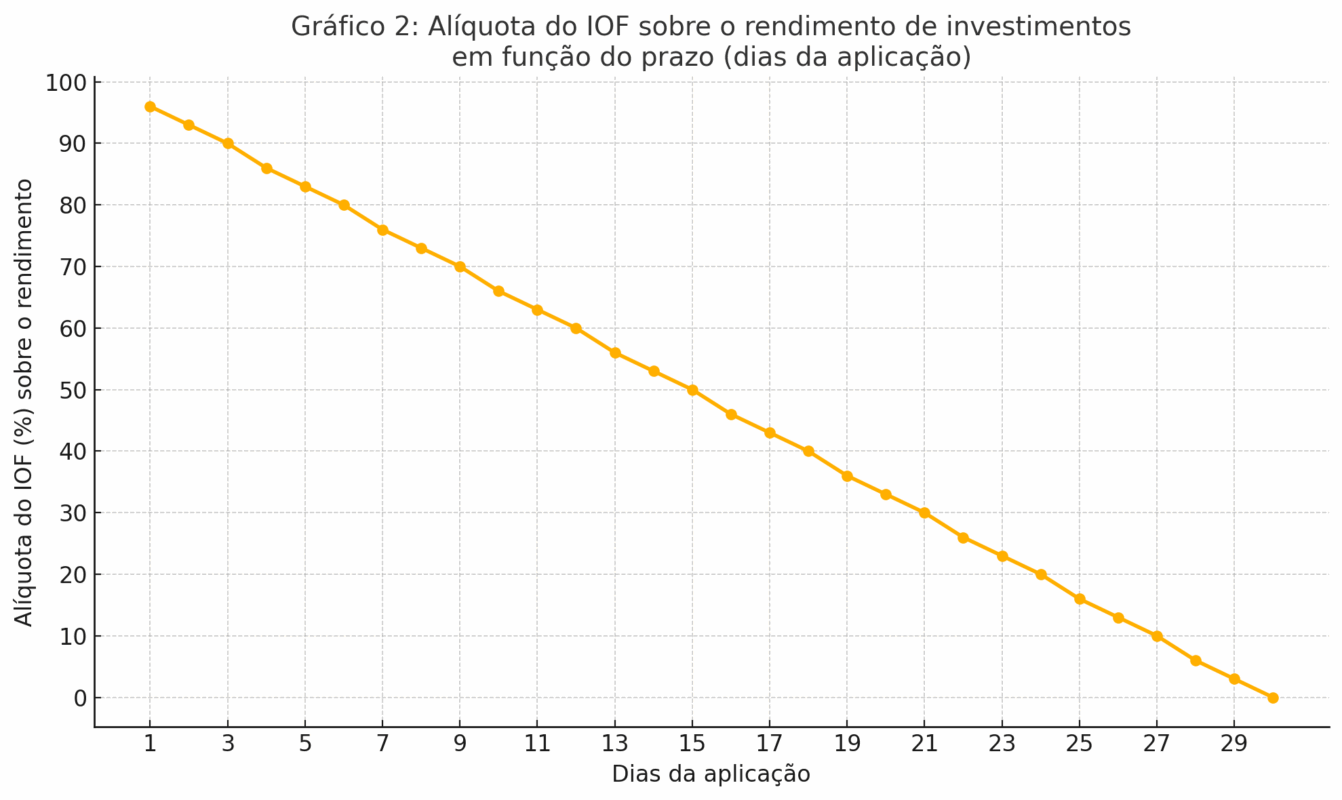

When a tax is levied, the calculation basis is not the amount invested itself, but rather the income (interest) produced by the application until the moment of redemption. The rate is defined by a daily regression table: starts at 96% (on income) for redemption at day 1 of the application, gradually reduces every day, and reaches 0% in 30th. In other words, if someone applies and withdraws the next day, practically the entire gain will be consumed by the IOF; if they withdraw after 15 days, the rate will be 50%; and from 30 full days onwards, there is no charge.

Important to note: IOF on investments is never levied on the principalonly on the profitability obtained

The table below (partial) illustrates the regressive IOF table for fixed-income investments (such as CDB, Treasury Direct, DI or short-term funds):

| Application time (calendar days) | IOF on income |

|---|---|

| 1 day (next day redemption) | 96% |

| 7 days | 76% |

| 15 days | 50% |

| 29 days | 3% |

| 30 days or more | 0% (exempt) |

Note: The original table has a defined rate for each day from 1 to 30. After the 30th day, no IOF is charged on income. The tax is withheld at the time of redemption by the financial institution.

Graph 2: Tax rate IOF on investment income depending on the term (days of application). You can see that the tax rate falls rapidly as the days go by. In day 1The IOF withholds 96% of the interest earned (the investor keeps only 4% of the income). Each day the rate decreases slightly (for example, ~50% at 15 days) until it reaches 0% on the 30th day. This shows the importance of wait 30 days or more before redeeming fixed-income investments, so as not to lose a large part of the gains in IOF.

Practical example: Imagine that a company invests R$ 1,000,000 in a CDB with daily liquidity and a yield of 1% per month. If, due to cash flow needs, she redeems the entire amount after 10 daysthe accumulated gross income will be around R$ 3,287 (approximately 0.3287% in 10 days). On this gain, the IOF for day 10 is 66%, i.e. around R$ 2.168 would be collected as IOF, leaving R$ 1,119 in income before other taxes. If the company manages to wait until 30 days to redeem, the IOF will be zeroand she will keep all the income (approximately R$ 10,000 in 30 days, considering 1% in the month) - being subject only to income tax on this gain, but not to the IOF. Conclusion: early redemptions of less than 30 days can eliminate most of the profitability of an investment, so the planning of cash flow you should try to avoid this situation. It's better to resort to emergency credit lines (comparing costs) than to lose almost all your income in IOF, for example.

In the context of Real Profit companies, it is common to invest surplus cash in funds or fixed-income securities to earn interest until they are used. The financial manager must calibrating deadlines - investments redeemed in less than 30 days are subject to IOF, so if you can, keep the funds invested for at least one month. After 30 days, in addition to no IOF, the company only pays income tax (15% to 22.5%, depending on the term, in the case of fixed income). Variable income operations (such as shares, FIIs) or long-term investments have no IOF on the principal or gains (except in atypical situations, such as loans backed by short-term shares, which fall outside the common scope). Thus, for investments, the IOF is mainly a factor for short-term liquidity managementIOF: it serves as a signal to avoid unnecessary financial transactions over very short periods of time. Again, the IOF paid is neither recoverable nor compensable; however, as it is automatically deducted from the return, it already appears net in the financial result and, when calculating the Real Profit, it is equivalent to less income (or financial expense) which naturally reduces the taxable profit.

Comparative Summary of IOF Rates

To make it easier to see, the following table consolidates the main ones types of IOF that impact Real Profit companies and their current rates (2025):

| Type of Financial Operation | Current IOF rate | Observations |

|---|---|---|

| Credit (PJ) - Loans, company financing | 0.38% (over value) + 0.0108% per day ≈ 3.95% p.a. | Equivalent to ~3.95% per year (PJ). For PF: 0.38% + 0.0082%/day (~3% p.a.). Home loans: exempt. |

| Foreign exchange - Buying foreign currency | 3.5% on the value in reais | Includes purchase of currency in kind. Was 1.1% until May 2025 |

| Foreign Exchange - Remittance abroad | 3.5% on the amount sent | Includes payments, services, etc. It was 0.38% by 2025. Remittances for investment: 1.1% |

| Foreign exchange - Entry from abroad | 0.38% on the amount received | Maintained for common entries (e.g. export receipts, loans). Foreign direct investment: exempt |

| Insurance - Assets | 7.38% on the premium | E.g. business insurance, car insurance. Maximum legal rate. |

| Insurance - Life (people) | 0.38% on the premium | Life risk and personal accident insurance. Private health: 2,38%. High VGBL contributions: 5% (new) |

| Investments - Fixed Income < 30 days | from 96% to 0% on income | Daily regressive table, 96% on day 1 decreasing to 0% on day 30. After 30 days: exempt. |

| Investments - Equities | 0% | Operations on the stock exchange (shares, FIIs) do not have IOF on the amount invested or earned. |

Table 1: Summary of the main IOF rates for companies (Real Profit) in 2025. Source: Own elaboration, with data from legislation and recent updates

Frequently Asked Questions (FAQ) about IOF for Real Profit Companies

1. Can the IOF paid be deducted or recovered from company taxes?

THE IOF does not generate tax credits to be offset - that is, unlike taxes such as ICMS (which can generate credit on the purchase) or non-cumulative PIS/Cofins, the IOF paid in a financial transaction cannot be recovered later. In the non-cumulative regime, taxes on inputs generate credits, but the IOF is not considered an input or service for PIS/Cofins credit purposes. On the other hand, for IRPJ/CSLL purposes in Real Profit, IOF expenses are deductible in the calculation of taxable income (since taxes, in general, can be considered an expense, unless prohibited by law).

This means that the IOF reduces the profit before IR/CSLL, slightly lessening the burden of these taxes. Even so, this is an indirect and partial recovery - in practice, the company bears most of the IOF as a whole. effective cost. In short: there is no way to fully recover the IOF paidHowever, accounting for it correctly as an expense at least guarantees its deductibility when calculating taxable income.

2. Are the IOF rates the same for individuals and companies?

Not exactly - there are differences in some modalities:

- In IOF on creditHistorically, companies had a lower daily rate than individuals. However, in 2025, the government raised the rate for companies to ~3.95% p.a. (0.0108% a day), staying until the end of the year. top to that of individuals (~3% p.a., 0.0082% a day). In other words, companies currently pay proportionally more IOF on loans than individuals.

- In Foreign exchange IOFThere is no distinction in the tax rate between individuals and companies based on the criteria of who carries out the transaction, but rather on the nature of the operation (for example, 3.5% for sending funds abroad, whether by an individual or a company; 1.1% for remitting investments, etc.). One practical difference is that use of an international credit card is more typical for individuals (travel, online shopping) and has an IOF of 3.5%, while companies generally use exchange contracts for remittances/payments, also taxed at 3.5%.

- In insuranceThere is no distinction between PF and PJ in the rates - it depends on the type of insurance (property, life, etc.), and the same rate applies regardless of the contractor.

- In IOF on investmentsThe 30 days), while for companies these IR-exempt securities do not exist (company pays IR on LCI/LCA), but in both cases IOF would be levied if redeemed before 30 days. In short, the general IOF rules apply to both, with some parameters that differ (especially in credit) and certain operations that are more relevant to one audience or another.

3. Which financial transactions do not have IOF?

Some operations are exempt or not subject to IOF by legal provision. Main examples:

- Residential real estate financingIOF: no IOF on credit for the purchase of own residential property

- ExportsFor the entry of foreign currency from exports, the exchange rate is 0.38% (minimum) or even exempt in some specific cases, which in practice means an almost zero burden for exporters.

- Foreign direct investmentForeign capital contributions to Brazilian companies (buying equity stakes) have zero IOF to attract investment.

- Stock Exchange transactions: buying/selling shares, real estate funds, derivatives on the stock exchange no IOF on the value traded. In other words, when investing or disinvesting in variable income after more than one day, there is no IOF (note: if someone invested in a fund and redeemed it on the day, there could be IOF as fixed income; but stock trades on the secondary market are not subject to IOF).

- Specific remittances abroadThe following situations have been maintained: exemption or reduced rate. E.g. transfers of resources from national investment funds investing abroad were left with IOF 0% after the government backed down in 2025. Payment transactions for interest on own capital and dividends abroad are exempt

- Gold financial assetIOF: the purchase/sale of gold, which is considered a financial asset, has zero IOF and is treated as currency under exchange rules.

In summary, most common operations will be subject to IOF, but the ones mentioned above are notable exceptions. Always consult the current legislation, as exceptions may change according to decrees (as we saw in 2025, when some exemptions were almost revoked and then maintained).

4. What can the company do to reduce the impact of the IOF?

Although the IOF is an indirect tax that is difficult to eliminate (there is no way of simply not paying it when the operation is necessary), some financial management practices can minimize its incidence:

- Cash planningavoid staying in overdraft or very short-term emergency loans, as these have a high daily IOF. It's better to have a working capital line negotiated in advance (with IOF already taken into account) than to pay IOF and interest on an overdraft.

- Grouping operationsFor example, if the company needs to make frequent payments abroad, check whether it is possible to consolidate amounts into fewer remittances, reducing the number of exchange operations with IOF of 3.5% each.

- Wait 30 days on investmentsIOF: as we have seen, redeeming financial investments after 30 days avoids IOF. Therefore, schedule fixed-income investments to have liquidity aligned with needs - if you know you'll need the money in 10 days, it might be better not to apply it at all (or already calculate the IOF on the account) or use another source.

- Negotiate longer-term loansIn the case of external loans, for example, avoiding short-term loans from abroad (as they now suffer IOF 3.5%) and opt for longer terms that may be exempt or have a lower charge. In the domestic market, longer terms don't reduce the IOF rate (which runs daily), but they do dilute the impact of the fixed 0.38% on the effective annual cost.

- Equity vs. debtIf you are looking for a loan, consider whether it would be more advantageous to use the partners' capital (capital increase) to finance the company instead of loans, as corporate contributions do not have IOF (but there are other aspects to consider). For transitional needs, consider anticipating receivables or extending terms with suppliers - although they may have costs, they don't directly involve IOF.

- Taking advantage of tax benefitsbe aware of possible special regimes. For example, companies in certain sectors or operations via international fintechs/hubs may have solutions where part of the exchange is made with a lower IOF (as some international fintech cards charge 1.1% IOF via a dollar account, in accordance with specific legislation). Always check that this is legal and that it suits your company's profile.

In short, the company must include the IOF in the calculation of the cost of each financial decision and look for the alternative with the lowest tax impact within the allowed limits. Sometimes, paying a little more interest to avoid a lot of IOF, or vice versa, can be advantageous - it's an optimization between financial and tax costs.

5. Are transactions between group companies or international loans subject to IOF?

Yes, if involve credit or foreign exchange, there will be IOFeven within the group:

- National intercompany loanIf a group company in Brazil lends money to another (both national legal entities), this formally constitutes a credit operation subject to IOF in the same way as with a bank. The company granting the loan must pay the IOF on the amount and term of the loan granted. Economic groups often choose to advance for future capital increase (AFAC) or other forms of transfer of funds between affiliates to avoid the IOF on loans, since there is no IOF on an AFAC (since it is not a credit operation but a capital contribution).

- Loan from company abroad to company in Brazil: This is inflow of foreign capital as debt - this foreign exchange operation was exempt from IOF for a long time if the loan term was longer than 180 days. However, since 2025, short-term foreign loans (up to 180 days) have been subject to an IOF of 3.5%. Longer-term foreign loans continue, in principle, with IOF 0% (but it is necessary to meet regulatory requirements, registration with the Central Bank, etc.). Therefore, international loans within the group should be carefully structured in terms of terms to minimize IOF.

- Distribution of profits, dividends, interest on capital abroad: These are not loans, but asset transfers. Dividends and Interest on Equity (JCP) sent abroad are exempt from IOF (zero rate), because you don't want to tax the outflow of profits that have already been taxed by the IRPJ/CSLL.

- Capital contributions (investment) from abroad to a group company in Brazil: as mentioned, foreign direct investment has zero IOF - so many multinationals prefer to capitalize the Brazilian subsidiary rather than take out loans, when possible, to avoid IOF and debt limits.

In short, financial operations intra-group are not immune from IOF just because they are between related parties. The nature of the operation (credit, exchange, etc.) determines this. Therefore, the company must plan with its partners or parent company the least costly way: for example, prefer capital contribution or long term instead of a short international loan, always considering the corporate and tax implications as a whole.

Conclusion

The IOF, despite often representing apparently "small" percentages, can have a significant impact in the cost of financial operations for Real Profit companies. Ignoring it in planning can lead to unpleasant surprises, such as eroded profitability or higher-than-expected effective financing costs. For this reason, financial managers and accountants must keep up to date with the current rates (which can change with decrees, as we saw in 2025) and include the IOF in the analysis of feasibility and budget. By taking the IOF into account from the outset - whether when taking out credit, deciding on a short-term investment strategy, or structuring international transactions - companies can optimize their results, avoid paying more taxes than necessary and even find more efficient alternatives. Ultimately, knowing and managing the IOF well is part of a good financial governance in the Brazilian corporate environment.

Do you need help to better structure your financial management and avoid surprises with IOF and other taxes? A CLM Controller accounting is an accounting boutique with more than 40 years of experience, specializing in accounting outsourcingtax consultancy and strategic planning for Real and Presumed Profit companies. You can count on a highly qualified team, personalized service and tailor-made solutions to make your operation more efficient, safe and profitable.

Get to know CLM Controller and turn your accounting into a real competitive differentiator.