The new phase of the Program is already in effect Zero litigation will be available to taxpayers, whether individuals or companies, who have tax arrears of up to R$ 50 million with the Internal Revenue Service.

What is Zero Litigation?

Zero Litigation is a program run by the Brazilian Federal Revenue Service that offers taxpayers the opportunity to settle their outstanding tax debts with discounts and special payment terms. The aim of the program is to reduce tax disputes, providing an alternative for taxpayers to resolve their tax issues more quickly and efficiently, avoiding legal proceedings and ensuring tax compliance.

Find out what discrepancies Operation Falso Simples found in social security contributions

Details of the discounts offered

The discounts vary according to the degree of recovery of the debt. For debts considered irrecoverable or difficult to recover, taxpayers can obtain a discount of up to 100% on the amount of interest, fines and legal charges, respecting the limit of up to 65% on the total amount of the debt. In this case, the taxpayer will make an initial payment of 10% of the consolidated value of the debt, after the discounts, divided into five installments, and the outstanding balance can be paid in up to 115 installments.

Learn more about: ICMS taxpayer, exempt taxpayer and non-taxpayer

Procedure for joining Zero Litigation 2024

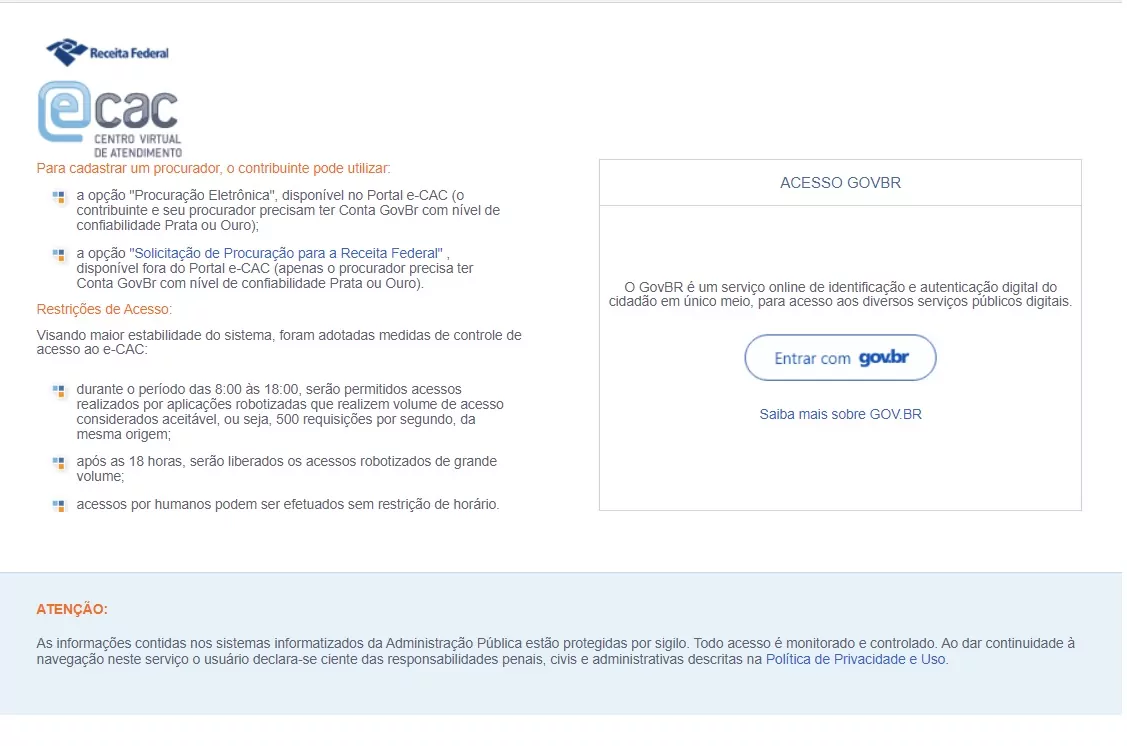

To join Zero Litigation 2024, taxpayers can do so through the Virtual Service Center Portal (e-Cac), in the "Legislation and Process" tab, (cav.receita.fazenda.gov.br), using the "Web Applications" service. During the period in which the application for membership is being analyzed, the processing of tax administrative proceedings relating to the debts included in the transaction is suspended.

New: Electronic work address becomes mandatory

Requirements and commitments

It is important to note that, in order to join the program, taxpayers must waive any administrative disputes or legal appeals regarding the debts included in the transaction, in addition to irrevocably and irreversibly acknowledging their status as the debtor of the debts in question, under the terms of the Code of Civil Procedure.

Learn why fiscal management is important

Take the opportunity to regularize

Don't miss this opportunity to regularize your tax issues and start the new year on the right foot! At CLM Controller, we offer intelligent and innovative solutions to simplify and optimize your company's tax management. Our expertise in automated tax bookkeeping provides an agile and efficient way of dealing with all tax issues, allowing you to focus on what really matters: growing your business. Click here to find out more about our solutions.