What are the differences and similarities between these two tax regimes? Find out in this article!

For telecommunications companies, the choice between the Real Profit or Presumed directly influences the level of the tax burden and impacts the financial health of the business. Therefore, understanding the differences between these regimes and identifying which is the most advantageous according to the company's turnover and profit margin is fundamental to optimizing costs.

In this article, we'll explain the characteristics of each tax regime and show how factors such as operational complexity and cost structure influence this decision. You'll also find out how CLM Controller assesses each case to help your company choose the best option. Join us!

Do you want to understand in practice which tax regime is best for telecom companies?

Listen to the chat in the new episode of our podcast! A direct conversation about the impacts of Real Profit and Presumed Profit on the sector, with valuable insights for entrepreneurs and managers looking for more strategic tax decisions.

What is Real Profit?

O Real Profit is a taxation system where taxes are calculated from the company's net profit, adjusted according to specific tax rules.

Its best-known feature is that it is mandatory for companies with an annual turnover of more than R$78 million, for financial institutions and for organizations that fall under other specific activities.

However, any company can opt for this system, regardless of turnover, as long as it is willing to meet the control and calculation requirements.

Under this regime, Corporate Income Tax (IRPJ) and Social Contribution on Net Profit (CSLL) are calculated based on the company's accounting profit, i.e. total revenue minus operating expenses and legal deductions.

The IRPJ rate is 15% on profit, with an additional 10% on what exceeds R$20 thousand per month. CSLL is levied at a rate of 9%.

The main feature of Real Profit is that taxes vary according to the company's financial performance. Companies that operate with low profit margins or make a loss can benefit, as they will pay less tax or, in some cases, be exempt.

However, the Real Profit requires very precise accounting, with strict control of income, expenses, inventories, depreciation and provisions. The complexity is significantly greater compared to other regimes, such as the Presumed ProfitThis can lead to higher accounting costs.

However, any company can opt for this system, regardless of turnover, as long as it is willing to meet the control and calculation requirements.

Under this regime, Corporate Income Tax (IRPJ) and Social Contribution on Net Profit (CSLL) are calculated based on the company's accounting profit, i.e. total revenue minus operating expenses and legal deductions.

The IRPJ rate is 15% on profit, with an additional 10% on what exceeds R$20 thousand per month. CSLL is levied at a rate of 9%.

The main feature of Real Profit is that taxes vary according to the company's financial performance. Companies that operate with low profit margins or make a loss can benefit, as they will pay less tax or, in some cases, be exempt.

However, the Real Profit requires very precise accounting, with strict control of income, expenses, inventories, depreciation and provisions. The complexity is significantly greater compared to other regimes, such as the Presumed ProfitThis can lead to higher accounting costs.

What is Presumed Profit?

In turn, the Presumed Profit is a simplified tax regime for companies with revenues of up to R$78 million per year. Unlike the Real ProfitThis model assumes a profit percentage on the company's gross revenue, on which IRPJ and CSLL are calculated.

The presumption percentages vary according to the company's activity. For service providers, such as telecommunications companies, the presumption of profit for IRPJ is generally 32% of gross revenue, and for CSLL, 12%.

The great advantage of Presumed Profit is the simplicity of taxation. Taxes are assessed directly, with fewer accounting control requirements and less need for a complex administrative structure. This reduces operating costs and facilitates tax planning.

However, this simplicity can become a trap for companies with low profit margins. Since the tax is calculated on an assumed margin and not on the real profitcompanies that make less profit than the presumed percentage end up paying more tax than they should.

On the other hand, highly profitable companies can find advantages in this regime, since the tax base is limited and predictable.

Which option is better for a telecommunications company: Real Profit or Presumed Profit?

In the telecom market, the choice between Real Profit e Presumed Profit depends on a number of factors, such as the volume of turnover, the effective profit margin, the cost structure and the administrative capacity to deal with accounting complexity.

Telecommunications companies tend to operate with varying profit margins, depending on the type of service offered (broadband, telephony, pay-TV, among others), the region in which they operate and the profile of their customers (residential, corporate, government). This diversity has a direct impact on the choice of tax regime.

For these organizations, the Presumed Profit can be advantageous when:

- annual turnover is less than R$ 78 million;

- the actual profit margin is equal to or greater than the presumed margin (32%);

- the company wants to simplify its tax assessment;

- administrative and accounting costs need to be kept low.

In such cases, the Presumed Profit can represent significant savings in time and resources, while ensuring predictability in the tax burden.

There are also, of course, situations in which Real Profit is a safer option when:

- the actual profit margin is lower than the presumed margin;

- there are many deductible costs and expenses, such as investments in infrastructure, maintenance and a robust payroll;

- the company operates with tax losses in certain periods;

- turnover exceeds R$78 million per year. In this case, Real Profit becomes mandatory;

- the company wishes to take advantage of PIS/COFINS tax credits (in a non-cumulative system).

In the telecommunications segment, where investments in infrastructure and technology are high, the Real Profit can be a strategic choice. Companies that make large investments can write off a significant part of these costs from their taxable income, reducing the amount of taxes owed.

To make our analysis even more complete, here are some other factors to take into account.

Turnover and profit margin

Companies with high turnover and tight profit margins tend to benefit from the Real ProfitThis is because they pay less tax based on their actual results. Smaller businesses, on the other hand, with more comfortable and predictable margins, tend to prefer Presumed Profit for its practicality.

Cost structure and tax deductions

In general, telecom companies spend a lot on equipment, networks, technology and qualified technical staff.

In Real ProfitIn addition, these expenses can be deducted from the IRPJ and CSLL calculation basis, which brings significant savings. In Presumed ProfitHowever, these deductions are not taken into account, which can artificially increase the tax burden.

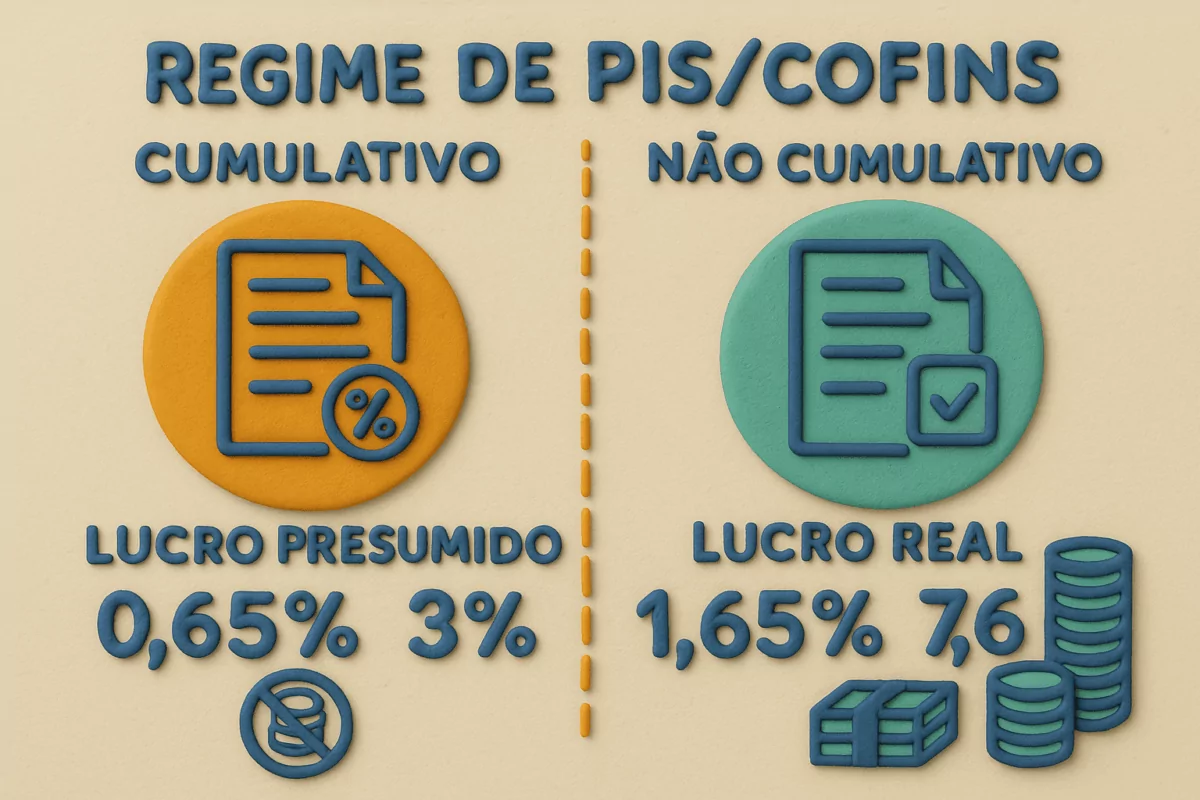

PIS/COFINS regime: cumulative vs. non-cumulative

O Presumed Profit works with the cumulative PIS and COFINS regime, with lower rates (0.65% and 3%, respectively), but without the possibility of credits.

The Real Profit uses the non-cumulative regime, with higher tax rates (1.65% and 7.6%), but allows the discount of credits on inputs, which can be advantageous for companies with large operating expenses.

Investments and reinvestments

Operators planning infrastructure expansion or technology migration (such as FTTH or 5G) should seriously consider the Real Profit.

This is because the investments made generate accounting deductions, which have a direct impact on the tax base and promote savings and increased competitiveness.

Management and accounting control skills

O Real Profit requires a higher level of financial controlIt is also easier to operate under this regime, with detailed accounting and robust compliance systems. Companies with structured administrative and accounting departments find it easier to operate under this regime.

Companies in the growth phase or with limited resources may prefer the Presumed Profit as a temporary strategy until operational maturity.

Predictability and tax planning

While Presumed Profit offers predictability in the amounts owed, which is ideal for companies that prefer a more stable cash flow. Real Profit allows for more technical planning, adapted to fluctuations in turnover and opportunities for tax exploitation.

So there is no single answer. Each case requires a detailed analysis, taking into account the company's operational and financial particularities. A technical and strategic assessment is essential to ensure that the telecommunications company chooses the most economical and efficient regime for its reality.

How does CLM Controller help your company define the best option?

CLM Controller specializes in accounting and tax planning for companies in the telecommunications sector.

We understand that each company has a unique structure, with different operational challenges, growth targets and financial contexts. That's why we offer a consultative approach, based on concrete data and reliable projections.

Our evaluation process follows careful stages, such as:

- a complete diagnosis of the company: we analyze turnover, actual profit margin, cost structure, investments and other relevant data.

- scenario simulation: Based on the data provided, we carried out comparative simulations between Real Profit and Presumed Profit, projecting the tax burden and financial impacts in each regime.

- evaluation of the administrative structure: we check whether the company has the technical and operational capacity to keep the bookkeeping required under Real Profit, or whether Presumed Profit is more viable due to its simplicity.

- analysis of tax benefits and tax risks: we identify possibilities for taking advantage of credits, regional or sectoral tax incentives, and assess the risks of tax assessments under each regime.

- personalized recommendations: we deliver a technical opinion with the most appropriate recommendation for the company's profile, always aligned with the strategic objectives of the business.

In addition, CLM Controller periodically monitors the company's results and tax developments to check whether the option chosen is still the most advantageous or whether there is a need to migrate. This continuous action ensures that your telecommunications company is always in compliance with the law and with the lowest possible tax impact.

Choosing the ideal tax regime is a strategic decision that directly influences your company's profitability and competitiveness. With the support of CLM Controller, your company can make this decision safely, intelligently and efficiently. Real Profit or Presumed? By analyzing our partners' data, we decided together!

Contact CLM Controller right now to understand which tax regime is best for your telecom company!