In the business world, keeping your company compliant with tax law is essential to avoid unnecessary problems and guarantee your success. To do this, it is important that your company adopts appropriate preventative measures to avoid falling foul of the tax authorities. In this article, we'll explore some of the main measures to ensure tax compliance and keep your business running smoothly.

Read more about: How to renegotiate and pay in installments debts with the IRS?

Read more about: Complete Guide to Adhering to the DET (Electronic Work Domicile)

If your company falls foul of the fine mesh, you could suffer many losses, such as:

- -Problems with the CNPJ;

- -Payment of fines;

- -Being investigated for tax evasion.

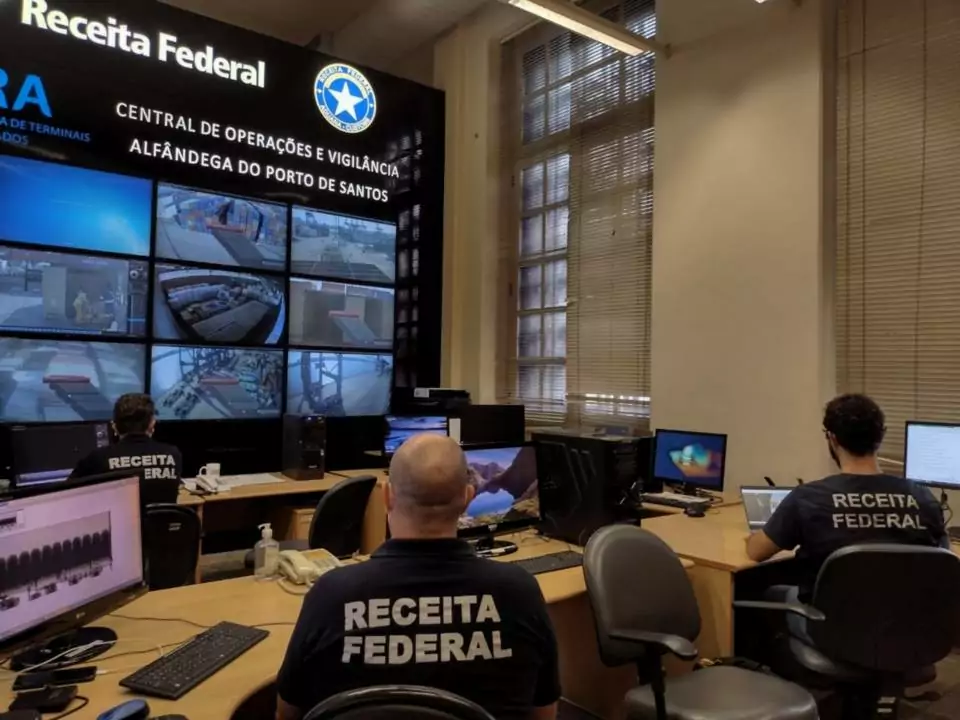

It is therefore essential to take the necessary steps to ensure that your company does not fall prey to the lion's share of the Receita Federal.

Know your fiscal and tax obligations

The first step to keeping out of the eyes of the tax authorities is to fully understand your financial responsibilities. This includes being familiar with all relevant tax obligations, such as income taxes, VAT, personal property taxes and other taxes specific to your industry or region. Also, make sure you understand the regulations relating to payroll, accounting e financial reports.

Your company's tax obligations are many and varied:

Tax collection;

DIRF - Withholding Tax Return;

DEFIS - Socioeconomic and Tax Information Statement;

ECF - Tax bookkeeping;

Issuing invoices.

New: Electronic work address becomes mandatory

Proper maintenance of documentation

By keeping accurate and up-to-date records, you facilitate the auditing process and reduce the risk of errors or omissions in the tax return. Make sure you store all receipts, invoices, bills and other relevant documents in a safe and organized place. Also, consider using online management systems to automate this process and ensure greater security when dealing with sensitive information.

Learn why fiscal management is important

Implementation of tax compliance policies

Create clear internal policies to ensure that all employees are aware of their tax obligations. These policies can include procedures for recording expenses, managing income, keeping financial records and meeting deadlines related to tax returns. Also, ensure that all employees have adequate training on these procedures and understand their importance in the company's tax compliance.

Read more about: Interest Simples Nacional: how to calculate overdue DAS

Regular internal audits

Periodic audits can help you identify and correct any problems before the tax authorities make their next inspection. These audits can be carried out by an internal department or by an external professional specializing in accounting and taxation. The aim is to check for errors in financial records, omissions in tax returns or any other irregularity that could lead to further investigation by the tax authorities.

Read more about: Learn how to prepare for an audit

Establish an open line of communication with the tax authorities

Maintain good relations with the tax authorities by establishing an open line of communication. This may involve maintaining regular contact with your local or regional representatives and being aware of changes in tax laws or regulations that may affect your company. In addition, if you are aware of any irregularities or errors in your previous returns, it is advisable to address these issues proactively to demonstrate your commitment to complying with all legal obligations.

Read more about: Tips on what to do when a Tax Auditor arrives at your company

Minimize risks and avoid the lion

In short, keeping your company away from the eyes of the tax authorities requires a combination of knowledge, organization, discipline and communication. By implementing preventive measures such as those mentioned above, you can minimize your risks and ensure that your business continues to thrive without unnecessary problems.

In CLM ControllerWe offer all the support you need to help your company avoid the fine mesh. Our team of experts in accounting and taxation is prepared to guide you and implement the best tax practices, ensuring that all obligations are fulfilled correctly and within the established deadlines. You can count on us to keep your finances in order and avoid any complications with the IRS.